Pedrovazpaulo Stocks Investment: Your Path to Smart Wealth Building

Pedrovazpaulo stocks investment offers a proven system for building long-term wealth. Many investors lose money because they lack a clear strategy. They chase trends, panic during downturns, and never build real wealth.

But there’s a better way.

This approach combines research-based stock selection with disciplined risk management. You’ll learn exactly how to pick winning stocks, protect your capital, and grow steadily. No guesswork. No gambling. Just systematic wealth building that works.

Whether you’re starting with $1,000 or $100,000, this guide shows you the path forward. Let’s dive in.

What Makes Pedrovazpaulo Stocks Investment Different

Most investment advice is either too complex or too simple. Pedrovazpaulo stocks investment strikes the perfect balance.

This method focuses on fundamentals over hype. You analyze companies based on real financial data. Revenue growth. Profit margins. Debt levels. Cash flow. These numbers tell the truth about a business.

The system also emphasizes proper diversification. You spread risk across multiple sectors and geographic regions. Technology stocks balance with healthcare. Domestic companies mix with international opportunities.

Risk management is built into every decision. You set position limits before buying. Stop-losses protect your capital automatically. Regular rebalancing maintains your target allocation.

Many investors with Pedro Vaz Paulo guidance report better sleep at night. They’re not worried about market swings. Their strategy handles volatility automatically.

Core Principles That Drive Success

Three key principles separate successful investors from struggling ones.

First is the margin of safety concept. You only buy stocks trading below their true value. This creates a cushion against mistakes or market downturns. Never overpay for potential.

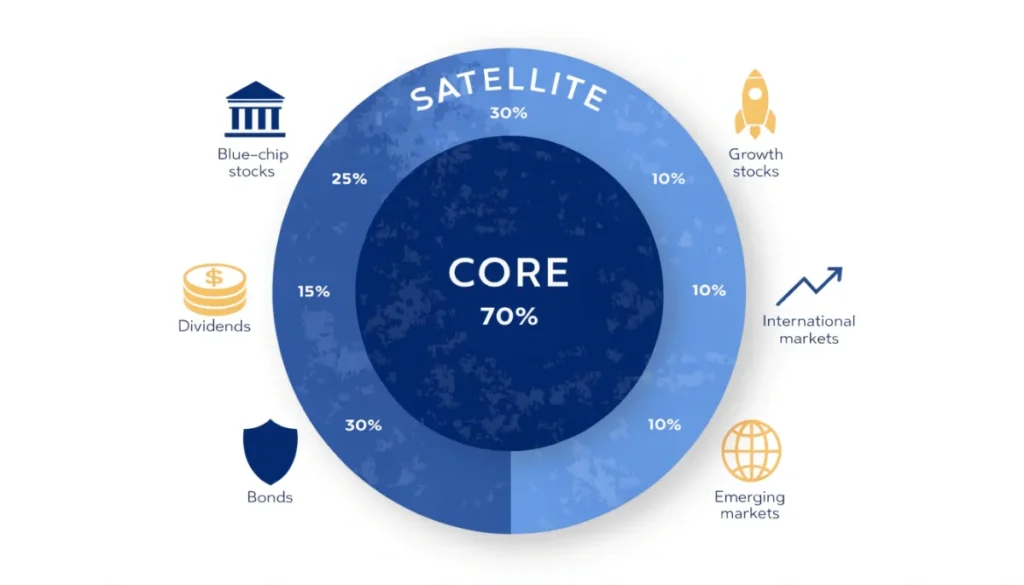

Second is the core-satellite portfolio structure. Place 60-80% in stable, proven companies. These are your blue-chip foundations. The remaining 20-40% goes to growth opportunities and tactical plays.

Third is emotional discipline. Markets will test your patience and nerves. Your system must protect you from yourself. Set rules. Follow them. Don’t deviate when fear or greed strike.

How to Find Top Rated Pedrovazpaulo Stocks Investment Opportunities

Finding quality stocks requires a systematic screening process. Start with quantitative filters.

Look for companies with price-to-earnings ratios below industry averages. Check debt-to-equity ratios under 0.5. Seek return on equity above 15%. These metrics identify financially healthy businesses.

But numbers aren’t everything. You need qualitative assessment too. Does management have a strong track record? Does the company have competitive advantages? Can they raise prices without losing customers?

Create a scoring system combining both factors. Rate each potential stock on a scale of 1-10. Only invest in those scoring 7 or higher.

The Three-Step Stock Evaluation Process

Step one is financial statement analysis. Review the last three years of income statements, balance sheets, and cash flow statements. Look for consistent growth and improving margins.

Step two involves industry positioning. How does this company compare to competitors? Are they gaining or losing market share? What threats could disrupt their business model?

Step three is valuation work. Calculate intrinsic value using discounted cash flow analysis. Compare to current market price. Buy only when you get at least a 20% discount.

This process takes time initially. But it becomes faster with practice. Soon you’ll spot opportunities quickly.

| Evaluation Factor | What to Look For | Red Flags |

|---|---|---|

| Financial Health | ROE > 15%, Low debt | Declining margins, High leverage |

| Market Position | Growing share, Strong brand | Losing customers, Weak differentiation |

| Valuation | Trading below intrinsic value | Overpriced relative to peers |

| Management | Proven track record | Frequent turnover, Poor capital allocation |

Building Your Pedrovazpaulo Stocks Investment Portfolio

Portfolio construction determines your long-term success more than individual stock picks. Get the structure right first.

Start with your core holdings. These should be 15-20 established companies with proven business models. Think large-cap stocks with consistent earnings. Companies that have survived multiple economic cycles.

Your core provides stability. These stocks won’t make you rich overnight. But they won’t destroy your wealth either. They grow steadily year after year.

Allocation Strategy That Works

Divide your equity allocation into clear buckets. Here’s a proven framework:

40% in blue-chip dividend payers. These generate income and provide downside protection. Companies like those in consumer staples and utilities.

30% in growth leaders. Technology and healthcare companies driving innovation. They offer higher returns but more volatility.

20% in international exposure. Access growth in emerging markets and developed economies outside your home country. This reduces single-country risk.

10% in tactical opportunities. Small-cap stocks, sector rotations, or special situations. These are your swing-for-the-fences positions.

Never let any single stock exceed 10% of your portfolio. Cap sector exposure at 25%. These limits prevent catastrophic losses from one bad decision.

Investors often combine this approach with pedrovazpaulo wealth investment strategies for comprehensive financial planning.

Risk Management: Protecting Your Capital

Making money is exciting. Not losing money is more important. Risk management keeps you in the game long enough to win.

Set stop-loss orders on every position. If a stock drops 15% from your purchase price, you automatically sell. No exceptions. This rule has saved countless investors from devastating losses.

Position sizing matters enormously. Never risk more than 2% of your total portfolio on any single trade. If you have $50,000 invested, that’s $1,000 maximum risk per position.

Creating Your Safety Net

Build cash reserves equal to 10-15% of your portfolio. This provides buying power during market crashes. When everyone else panics and sells, you can buy quality stocks at bargain prices.

Stress test your portfolio quarterly. Model how much you’d lose in various scenarios. A 20% market correction. A sector-specific crash. A currency crisis. If potential losses exceed your comfort level, adjust allocations.

Diversification is your first line of defense. Spread investments across:

- 8-10 different sectors

- 3-5 geographic regions

- 15-25 individual stocks

- Multiple market cap ranges

This prevents any single event from wiping out your wealth.

Professional guidance from pedrovazpaulo financial consulting can help optimize your risk framework.

Finding Pedrovazpaulo Stocks Investment Services Open Now

Access to quality investment guidance matters for your success. Many investors waste time with outdated advice or unavailable resources.

Look for services offering real-time market analysis and immediate support. You need answers when questions arise, not three days later. Active market hours support is essential.

Digital platforms provide instant access. Modern investment services operate 24/7 through online portals. You can review recommendations, adjust positions, and access research anytime.

What to Expect from Quality Services

Top-tier investment services include several key features:

Personalized portfolio reviews happen at least quarterly. Your advisor analyzes performance, suggests adjustments, and keeps you on track toward goals.

Educational resources help you improve continuously. Webinars, articles, and video tutorials build your knowledge. You become a better investor over time.

Research reports provide actionable insights on individual stocks and market trends. These save you countless hours of analysis work.

24/7 platform access lets you monitor positions and execute trades on your schedule. No waiting for office hours.

| Service Feature | Why It Matters | What to Avoid |

|---|---|---|

| Real-time updates | Make timely decisions | Day-old information |

| Personal advisor access | Customized guidance | Generic advice only |

| Educational content | Continuous improvement | Sales pitches disguised as education |

| Mobile accessibility | Manage anywhere | Desktop-only platforms |

Many successful investors supplement stock strategies with pedrovazpaulo crypto investment for additional diversification.

Advanced Strategies for Maximum Returns

Once you master the basics, advanced techniques can boost returns significantly. These methods require more skill but deliver better results.

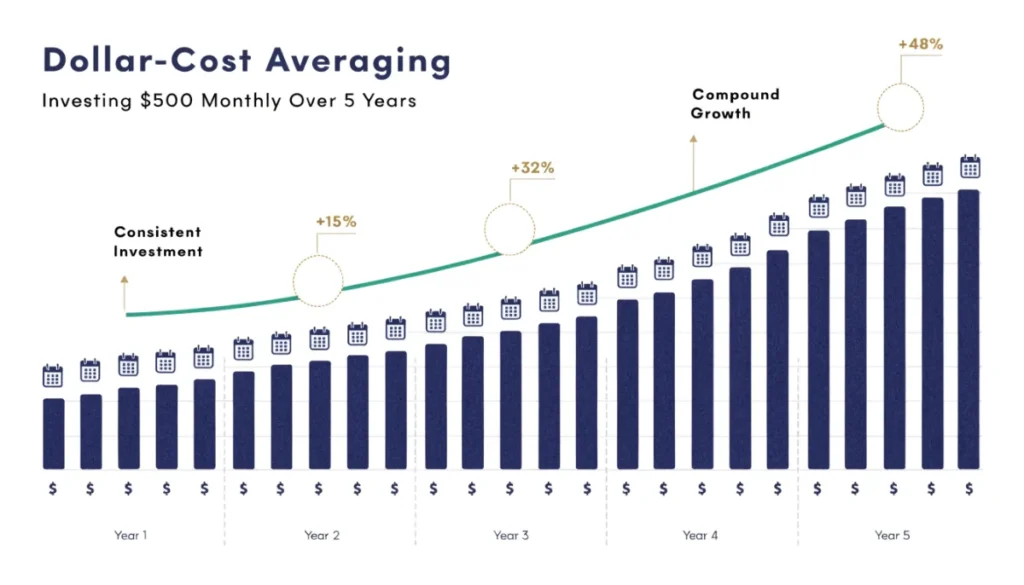

Dollar-cost averaging eliminates timing risk. Invest fixed amounts monthly regardless of market conditions. You automatically buy more shares when prices drop and fewer when they rise. Over years, this strategy beats trying to time the market.

Dividend reinvestment compounds your wealth faster. Instead of taking cash dividends, automatically purchase more shares. A 3% dividend yield becomes 4-5% when reinvested over decades.

The Core-Satellite Approach

This two-tier strategy maximizes both stability and growth potential. Your core holdings provide predictable returns with lower risk. Satellite positions offer asymmetric upside.

Core positions should represent 70% of your equity allocation. Select companies with:

- 10+ years of profitability

- Dividend growth for 5+ consecutive years

- Market capitalization above $10 billion

- Dominant positions in stable industries

Satellite positions get the remaining 30%. Focus on:

- Emerging market opportunities

- Small-cap growth stocks

- Sector-specific themes (AI, renewable energy, biotech)

- International expansion stories

Rebalance quarterly to maintain these proportions. When satellites grow too large, trim them back. When they shrink, add capital.

For entrepreneurs balancing business and investing, pedrovazpaulo entrepreneur resources offer valuable insights.

Tax Efficiency: Keeping More of Your Gains

Taxes can destroy 30-40% of your investment returns. Smart tax planning is mandatory for wealth building.

Hold investments longer than one year whenever possible. Long-term capital gains rates are significantly lower than short-term rates. That 15% difference compounds dramatically over time.

Use tax-advantaged accounts strategically. Place high-growth stocks in retirement accounts where gains aren’t taxed annually. Keep dividend payers in taxable accounts where you can benefit from qualified dividend rates.

Tax-Loss Harvesting Technique

This powerful strategy reduces your tax bill while maintaining market exposure. Here’s how it works:

Sell losing positions before year-end to realize capital losses. These losses offset capital gains from winning positions. You can deduct up to $3,000 of net losses against ordinary income annually.

The key is replacing sold positions immediately with similar but not identical investments. This maintains your market exposure while capturing the tax benefit.

For example, if you sell a technology ETF at a loss, immediately buy a different technology ETF. You stay invested but get the tax deduction.

Business owners can integrate investment strategies with pedrovazpaulo business consultant services for comprehensive wealth management.

Monitoring and Rebalancing Your Portfolio

Set-it-and-forget-it doesn’t work in investing. Regular maintenance keeps your portfolio optimized and on track.

Review your holdings quarterly. Check if allocations have drifted from targets. A winning stock might grow from 5% to 12% of your portfolio. That creates concentration risk.

Track these key metrics during reviews:

- Individual position sizes

- Sector allocations

- Geographic exposure

- Overall portfolio beta

- Dividend yield trends

When to Rebalance

Set specific triggers for rebalancing actions. Don’t just rebalance on a calendar schedule.

Rebalance when any position exceeds 10% of total portfolio value. Sell enough shares to bring it back to target weight. This forces you to take profits from winners.

Rebalance when sectors drift beyond 5% of target allocation. If technology grows from 25% to 31%, trim it back. Buy underweighted sectors with the proceeds.

Rebalance after major life changes. New job, marriage, or nearing retirement all require portfolio adjustments. Your risk tolerance and time horizon shift.

Combining stock investments with pedrovazpaulo operations consulting creates operational synergies for business owners.

Common Mistakes to Avoid

Even experienced investors make predictable errors. Learn from others’ mistakes instead of your own.

Overconcentration destroys portfolios. Falling in love with one stock leads to disaster. No matter how confident you feel, limit individual positions to 10%. Many brilliant companies fail unexpectedly.

Chasing performance guarantees poor returns. Last year’s hot stocks rarely repeat. Buying at peak prices locks in mediocre returns. Focus on value, not momentum.

Emotional Decision-Making

Fear and greed ruin more portfolios than poor stock selection. Your brain works against you during market extremes.

During market crashes, fear screams “sell everything!” This locks in losses and misses the recovery. Your system should have predetermined rules for downturns. Follow them mechanically.

During bull markets, greed whispers “buy more!” This leads to overexposure and poor risk management. Stick to your allocation plan regardless of how good things feel.

Keep an investment journal documenting every buy and sell decision. Record your reasoning at the time. Review quarterly to identify emotional patterns.

Leaders can develop better decision-making through pedrovazpaulo executive coaching programs.

Tools and Resources for Success

The right tools make investing easier and more effective. You don’t need expensive Bloomberg terminals. But you do need quality resources.

Free screening tools help identify potential investments. Finviz and Yahoo Finance provide robust filtering capabilities. Search by P/E ratio, market cap, dividend yield, and dozens of other metrics.

Portfolio tracking software monitors performance and maintains records. Personal Capital and Morningstar offer free options. Track returns, allocations, and fees in one dashboard.

Essential Research Platforms

Build your research workflow around these resource types:

Financial statements and SEC filings provide primary data. Visit the SEC’s EDGAR database for free access to 10-Ks, 10-Qs, and proxy statements. These documents contain everything you need.

Earnings call transcripts reveal management thinking and business trends. Seeking Alpha publishes these free within hours of calls. Listen for changes in tone or strategy.

Industry research reports provide context and competitive analysis. Your brokerage firm likely offers free research. Many sell-side analysts provide solid industry overviews.

News aggregators keep you informed on holdings. Google Finance and Yahoo Finance compile relevant news automatically. Set alerts for your stocks.

| Tool Category | Free Options | Premium Alternatives |

|---|---|---|

| Stock Screeners | Finviz, Yahoo Finance | Zacks, Stock Rover |

| Portfolio Tracking | Personal Capital, Mint | Sharesight, Kubera |

| Research | SEC EDGAR, Seeking Alpha | Morningstar Premium, FactSet |

| Charts/Technical | TradingView (basic) | TradingView Pro, TC2000 |

Technology-focused investors benefit from pedrovazpaulo it consulting expertise in digital transformation.

International Diversification Strategies

Limiting yourself to domestic stocks caps your potential returns. International markets offer compelling opportunities.

Emerging markets provide faster growth than developed economies. Countries like India, Vietnam, and Brazil are growing GDP at 5-7% annually. Corporate earnings grow even faster.

Developed international markets reduce concentration risk. European and Japanese companies operate in different economic cycles. This smooths your portfolio returns over time.

Accessing Global Opportunities

You have several options for international exposure. Each has trade-offs.

Individual foreign stocks give you direct ownership and maximum control. But you face currency risk, foreign tax complications, and less information access.

American Depositary Receipts (ADRs) trade on US exchanges but represent foreign companies. These solve liquidity and currency issues. Major foreign firms offer ADR options.

International ETFs provide instant diversification across regions. A single fund can hold hundreds of foreign stocks. Management fees are typically low.

Mutual funds with active management can outperform in less efficient markets. Emerging market funds especially benefit from professional stock selection.

Allocate 20-30% of equity holdings to international investments. Split this between developed markets (15-20%) and emerging markets (5-10%).

Strategic planning across markets aligns with pedrovazpaulo strategy consulting principles.

Building Wealth Within 20 Mi of Your Location

Local investment opportunities often get overlooked. But they can provide unique advantages and insights.

Regional banks and credit unions operating near you may offer attractive valuations. You can visit branches, talk to management, and assess service quality firsthand.

Local publicly-traded companies give you information advantages. You see their stores, use their products, and observe operations personally. This real-world research supplements financial analysis.

Leveraging Local Knowledge

Your geographic proximity creates research edges in specific situations.

Real estate investment trusts (REITs) owning properties in your area become easier to evaluate. Drive by their buildings. Assess locations and property conditions. Check local rental rates and occupancy.

Retail and restaurant chains with significant local presence provide observable data. Are parking lots full? How do employees behave? What do customers say?

Regional manufacturers and distributors may dominate your area while flying under Wall Street’s radar. These hidden gems sometimes deliver outsized returns.

Don’t limit your entire portfolio to local stocks. But having 5-10% in companies you can monitor personally adds a valuable dimension.

Marketing expertise from pedrovazpaulo marketing consulting helps evaluate consumer-facing companies.

Performance Tracking and Continuous Improvement

You can’t improve what you don’t measure. Rigorous performance tracking separates great investors from average ones.

Compare your returns to appropriate benchmarks. If you invest primarily in large-cap US stocks, use the S&P 500. International holdings should beat MSCI EAFE. Don’t just focus on absolute returns.

Calculate risk-adjusted returns using the Sharpe ratio. This measures return per unit of risk taken. A 12% return with high volatility may be worse than 10% with low volatility.

Key Metrics to Monitor Monthly

Track these five metrics consistently:

Total return shows your bottom-line performance. Include dividends and capital gains. Compare to your goals, not just market indexes.

Portfolio volatility measures how much your account value swings. Standard deviation calculations quantify this. Lower is generally better for the same returns.

Maximum drawdown reveals your worst peak-to-trough decline. Can you emotionally handle a similar future drop? If not, reduce risk now.

Expense ratio combines all fees and costs. Each 0.5% in fees reduces long-term wealth by 10-15%. Minimize expenses aggressively.

Tax efficiency shows how much of your returns you keep after taxes. Calculate after-tax returns. This number matters more than pre-tax performance.

Review these metrics at month-end. Adjust strategy when performance deviates significantly from expectations.

Professional development through pedrovazpaulo coaching supports continuous investor improvement.

Frequently Asked Questions

Take Action and Start Building Wealth Today

Pedrovazpaulo stocks investment provides a clear roadmap for long-term wealth creation. You’ve learned the systematic approach to stock selection, portfolio construction, and risk management.

The key principles are simple. Focus on undervalued companies with strong fundamentals. Diversify properly across sectors and regions. Manage risk through position limits and regular rebalancing. Optimize taxes to keep more of your gains.

Start small but start now. Open a brokerage account today. Invest your first $1,000 in 2-3 solid companies. Learn from real experience, not just theory.

Review your portfolio quarterly. Track performance against benchmarks. Adjust strategy as you learn and grow. Wealth building is a marathon, not a sprint.

The difference between financial security and struggle often comes down to taking that first step. You now have the knowledge and framework. Take action today.