PedroVazPaulo Financial Consulting: Your Guide to Smarter Business Money Management

PedroVazPaulo financial consulting helps businesses stop bleeding cash and start thriving. Too many companies fail not because their ideas are bad, but because they mismanage money. Cash flow confusion kills promising startups every single day. The timing of payments destroys profitable businesses.

Here’s the reality: You can’t wing financial decisions anymore.

The market moves too fast. Costs shift overnight. Competitors adapt instantly. Your gut feeling isn’t enough to survive and scale. You need clear numbers, sharp forecasts, and actionable plans that actually work.

That’s exactly what pedrovazpaulo financial consulting delivers. No fancy jargon. No cookie-cutter templates. Just tailored strategies that connect your financial moves to real business results. You get dashboards that make sense. Forecasts you can trust. Plans that match your risk tolerance and timeline.

This guide reveals everything you need to know. We’ll cover who benefits most from financial consulting. You’ll discover the core services that transform struggling businesses into profitable powerhouses. Plus, you’ll learn how to choose the right consulting approach for your specific situation.

Let’s turn your financial confusion into competitive advantage.

What Makes PedroVazPaulo Financial Consulting Different

Most financial consultants talk theory. PedroVazPaulo financial consulting rolls up its sleeves and gets to work.

The difference starts with the approach. Every engagement begins with a quick diagnostic audit. This isn’t a months-long analysis paralysis situation. You get fast identification of major issues and opportunities within days.

Hands-On Implementation, Not Just Advice

Traditional consultants deliver fancy PowerPoint decks and disappear. PedroVazPaulo stays until your team owns the process completely. They build the models with you. They automate your reporting systems. They train your staff to maintain everything independently.

Think of it like this: Most consultants design the car and leave. PedroVazPaulo installs the brakes, teaches you to drive, and rides along until you’re confident behind the wheel.

Data-Driven Decisions Replace Gut Feelings

Every recommendation comes backed by solid analytics. No vague hunches or industry generalities. You get scenario-based predictions with adjustable variables. Want to see what happens if you bump prices by 10%? Done. Curious about delaying three hires by two months? The model shows you instantly.

This top rated pedrovazpaulo financial consulting methodology integrates predictive modeling, KPI tracking, and data visualization. Your leadership team finally sees the real story on revenue, profits, and cash position.

The competitive edge? PedroVazPaulo bridges big-picture strategy with ground-level execution. Many firms from pedrovazpaulo strategy consulting excel at planning but stumble during implementation. Others focus only on tactical fixes without strategic vision.

PedroVazPaulo combines both perfectly.

Core Services That Transform Business Finances

PedroVazPaulo financial consulting offers six essential services. Each one addresses specific pain points that cripple growth.

Financial Strategy and Forecasting

You get forecasts covering sunny days, steady periods, and potential storms. The models include adjustable dials for pricing changes, ad spending shifts, hiring timelines, and funding rounds.

This isn’t static spreadsheet work. You’re building a living financial command center. Test different scenarios instantly. See the impact before committing resources.

Startups especially benefit here. You’ll discover if your runway extends six months or six weeks. That knowledge changes everything.

Cash Flow and Working Capital Management

Profitable companies still go bankrupt. Why? Terrible cash timing.

You might show $50,000 profit on paper. But if customers pay in 90 days while you owe suppliers in 30 days, you’re in trouble. PedroVazPaulo tightens payment terms, optimizes inventory levels, and builds safety nets for unexpected curveballs.

The result? Your money works when you need it most.

Investment and Capital Advisory

Raising funds terrifies many founders. PedroVazPaulo shapes the deals, runs projections on outcomes, and creates materials that grab investor attention.

They transform your daily operations into compelling stories with numbers that seal deals. Whether you’re chasing venture capital, negotiating loans, or preparing for acquisition, you’ll have investor-grade financials that withstand scrutiny.

Similar principles apply across pedrovazpaulo business consultant services turning complex situations into clear opportunities.

Profitability and Pricing Strategy

Most businesses leave money on the table. Small pricing tweaks unlock massive gains they never see coming.

PedroVazPaulo breaks down per-unit costs, analyzes margins by channel, and models how price adjustments ripple through your business. You’ll uncover hidden profit pockets in products you thought were marginal.

Risk Management and Compliance Readiness

Nasty surprises kill momentum. Compliance issues delay funding. Audit problems derail exits.

You receive straightforward risk assessments, protective safeguards, and compliance checklists tailored to your location and industry. Everything prepares you for funding rounds, audits, or acquisitions without last-minute panic.

Finance Function Build-Out

Need a full-time financial planner? Considering a fractional CFO? PedroVazPaulo drafts job specifications, vets candidates, and coaches your team for sustained success.

The expertise from pedrovazpaulo executive coaching ensures your finance function grows without permanent dependency on outsiders.

Who Benefits Most from Financial Consulting Services

Not every business needs the same financial help. Understanding your situation determines the right approach.

Startups with Traction But Unclear Economics

You’ve got customers. Revenue flows in. But you can’t explain why certain customers cost more to serve. Your unit economics puzzle everyone on the team.

PedroVazPaulo financial consulting excels here. They dissect customer acquisition costs, lifetime value calculations, and channel profitability. Within weeks, you understand exactly which customers drive real profit versus vanity metrics.

Growing Companies Facing Expansion Decisions

Scaling brings new complexity. Should you open that second location? Can you afford ten new hires? Will international expansion destroy your cash reserves?

Guesswork becomes expensive at this stage. One wrong expansion decision costs six figures minimum. Financial consulting provides the modeling and scenario testing that prevents costly mistakes.

Established Businesses Seeking Steady Oversight

Mature companies need consistent financial discipline. Quarterly reporting requirements, investor updates, and regulatory compliance demand professional structure.

Many established firms use pedrovazpaulo financial consulting open now services for ongoing retainers. They get steady financial oversight without hiring a full-time CFO.

Solo Founders Preparing Investor Pitches

Investors smell weak financials instantly. Your pitch deck needs bulletproof numbers. Your financial projections must withstand aggressive questioning.

PedroVazPaulo polishes your books to investor-grade quality. They stress-test your fund-use plans and build pitch deck financials that impress rather than confuse.

The expertise extends beyond numbers—leadership development through pedrovazpaulo coaching ensures founders communicate financial strategies confidently.

How to Find PedroVazPaulo Financial Consulting Near You

Location matters less than you think for financial consulting. Most work happens remotely through video calls and shared dashboards.

Searching for Local Options

Want to find pedrovazpaulo financial consulting within 20 mi of your office? Start with a targeted web search. Include your city name with the search term. Check professional networks like LinkedIn for consultants in your region.

Local consultants understand regional business regulations better. They know your market dynamics intimately. Face-to-face meetings sometimes clarify complex situations faster than video calls.

Evaluating Remote Consulting Services

Geographic boundaries disappear with modern tools. PedroVazPaulo financial consulting 营业中 (open for business) serves clients globally through cloud-based platforms.

Remote consulting offers advantages:

- Access to top-tier expertise regardless of your location

- Typically lower fees than local Big Four firms

- Flexible scheduling across time zones

- Faster response times through digital communication

The key factor? Results matter more than proximity.

Accessibility and Convenience Features

Look for pedrovazpaulo financial consulting 无障碍入口 (accessible entry points) that make engagement simple. The best consultants offer:

- Online booking systems for initial consultations

- Clear pricing information upfront

- Fast response times to inquiries

- User-friendly client portals for document sharing

Modern financial consulting should feel frictionless. If scheduling a call takes two weeks, that’s a red flag.

For businesses exploring pedrovazpaulo financial consulting 5英里内 (within 5 miles), verify the firm actually maintains local offices versus just listing addresses. Some consultants operate entirely remotely but list multiple locations for SEO purposes.

Integration with related services like pedrovazpaulo operations consulting ensures comprehensive business support beyond just financial matters.

The Engagement Process: What to Expect

Understanding the consulting timeline helps you prepare properly. PedroVazPaulo financial consulting follows a structured five-phase approach.

Phase One: Discovery and Audit (Week 1-2)

The engagement kicks off with a rapid financial review. Expect deep dives into cash flow patterns, reporting accuracy, and pricing structure.

This phase uncovers the biggest leaks fast. You’ll identify quick wins that pay off immediately—like tightening payment terms or adjusting invoice timing to boost immediate cash.

Prepare these materials beforehand:

- Past 12-24 months of financial statements

- Current cash flow trackers and budgets

- Historical forecasts versus actual results

- Payroll details and employment agreements

- Outstanding loan terms and credit agreements

Quick responses from your leadership team accelerate everything. Assign one point person for communication and decision-making.

Phase Two: Roadmap and Quick Wins (Week 3-4)

By month one, you receive a single-page strategic roadmap. This isn’t a hundred-slide deck. It’s a clear guide prioritizing actions by impact and urgency.

Plus, you implement at least one easy victory immediately. Maybe renegotiating supplier payment terms adds $20,000 cash instantly. Perhaps adjusting billing cycles improves monthly cash flow by 15%.

These quick wins build momentum and demonstrate value before major implementations begin.

Phase Three: Implementation (Month 2-4)

Now the real transformation happens. PedroVazPaulo builds custom financial models for your business. They automate reporting systems so data updates without manual spreadsheet wrestling.

Your team receives comprehensive training. Systems get rolled out with hands-on support. New routines integrate into daily operations smoothly.

This phase demands your active participation. Financial consulting fails when clients expect consultants to do everything. Your team must engage, learn, and eventually own these systems.

The collaborative approach mirrors techniques from pedrovazpaulo marketing consulting building internal capabilities while delivering external expertise.

Phase Four: Monitoring and Optimization (Month 5-6)

With systems operational, focus shifts to maintenance and refinement. You establish regular check-in rhythms weekly dashboards, monthly predictions, quarterly deep dives.

Ongoing scenario planning keeps you nimble. Test new strategies before committing resources. Model different growth paths with confidence.

Phase Five: Handover and Independence

The final phase ensures your team operates independently. You receive comprehensive guides, templates, and documentation for everything built.

Training continues until your staff confidently maintains all systems without external help. This isn’t abandonment—it’s empowerment.

Most consultancies create dependency. PedroVazPaulo creates capability.

For businesses managing diverse operations, coordination with pedrovazpaulo it consulting ensures financial systems integrate smoothly with existing technology infrastructure.

Pricing Models and Investment Considerations

PedroVazPaulo financial consulting adapts pricing to match your needs and situation. Understanding options helps you budget appropriately.

Fixed-Price Project Engagements

Best for defined scope work. You need specific deliverables—investor deck financials, fundraising materials, or compliance audit preparation.

Pricing stays predictable. You know the total cost upfront. No surprise invoices or scope creep billing.

Typical projects run $5,000-$25,000 depending on complexity. A simple cash flow analysis costs less than complete financial system overhaul.

Ongoing Retainer Arrangements

Growing businesses benefit from continuous financial oversight. Monthly retainers provide steady access to expertise without full-time CFO salaries.

Expect $3,000-$10,000 monthly depending on service depth. You get regular reporting, monthly forecasting updates, quarterly strategic reviews, and on-demand advisory support.

Retainers work well for pedrovazpaulo financial consulting 在线预约 (online booking) situations where you need consistent touchpoints with flexible scheduling.

Results-Based Compensation

For measurable goals, some engagements tie fees to outcomes. Save 20% on operating costs? Extend runway by six months? Improve margins by specific percentages?

Payment structures reflect the value delivered. This model works when targets are crystal clear and outcomes are verifiable.

Quick Diagnostic Audits

Need fast assessment without major commitment? Diagnostic audits typically cost $2,000-$5,000.

You get a comprehensive financial health check, prioritized improvement list, and quick-win recommendations. Perfect for bootstrapped startups or businesses exploring whether full consulting engagement makes sense.

The ROI Reality Check

Smart consulting fees pay for themselves quickly. Extend your cash runway by three months? That’s worth tens of thousands. Trim burn rate by 15%? You’ve multiplied the fee back within quarters.

Always demand clear success metrics upfront. Vague promises mean nothing. Specific KPIs tied to business outcomes prove value definitively.

The investment principles align with approaches from pedrovazpaulo wealth investment focusing on measurable returns rather than just activity.

Comparing Financial Consulting Options

| Consulting Type | Best For | Typical Cost | Engagement Speed | Implementation Depth |

|---|---|---|---|---|

| Big Four Firms | Large corporations, complex compliance | $50,000+ | 2-3 months to start | Comprehensive but slow |

| PedroVazPaulo | Startups, growing businesses | $5,000-$25,000 | 1-2 weeks to start | Hands-on until independence |

| Fractional CFO | Ongoing strategic finance | $5,000-$15,000/month | 2-4 weeks to start | Deep but narrow focus |

| Investment Banks | M&A, major fundraising | Transaction-based | 1-2 months to start | Deal-specific only |

| Accounting Firms | Compliance, tax optimization | $3,000-$10,000 | Variable | Backward-looking |

Red Flags When Choosing Financial Consultants

Not all consultants deliver equal value. Watch for warning signs that indicate potential problems.

Promises of Guaranteed Valuations

No legitimate consultant guarantees specific company valuations. Too many variables exist outside anyone’s control. Market conditions shift. Investor appetites change. Competitor actions impact perception.

Realistic consultants provide valuation ranges based on comparable companies and financial metrics. They prepare you for investor conversations without making impossible promises.

Zero Measurable Metrics

Ask: “How will we measure success?” Vague responses like “improved financial health” mean nothing.

Demand specific KPIs from day one. Extend cash runway by X months. Reduce burn rate by Y percent. Improve forecast accuracy to within Z percent.

Top rated pedrovazpaulo financial consulting services always establish clear success metrics upfront.

No Similar Client Stories

Experience matters enormously. Ask for case studies from businesses like yours. SaaS companies need consultants who understand recurring revenue models. E-commerce requires expertise in inventory management and seasonality.

Generic consultants claiming they help “all businesses” usually help none particularly well.

Weak Data Security Practices

You’re sharing sensitive financial information. Ask about NDAs, data encryption, secure file sharing protocols, and confidentiality policies.

Consultants who seem casual about security will be equally casual with your competitive secrets.

Junior Staff Doing Senior Work

You hire the experienced partner but get the inexperienced associate. Clarify exactly who performs the work. Who builds your models? Who analyzes your data? Who leads your strategy sessions?

Bait-and-switch staffing wastes time and delivers mediocre results.

For entrepreneurs building ventures, expertise from pedrovazpaulo entrepreneur services ensures consultants understand startup dynamics intimately.

Real-World Scenarios and Outcomes

Understanding how pedrovazpaulo financial consulting solves actual problems helps you evaluate fit for your situation.

SaaS Company: Revenue Recognition Chaos

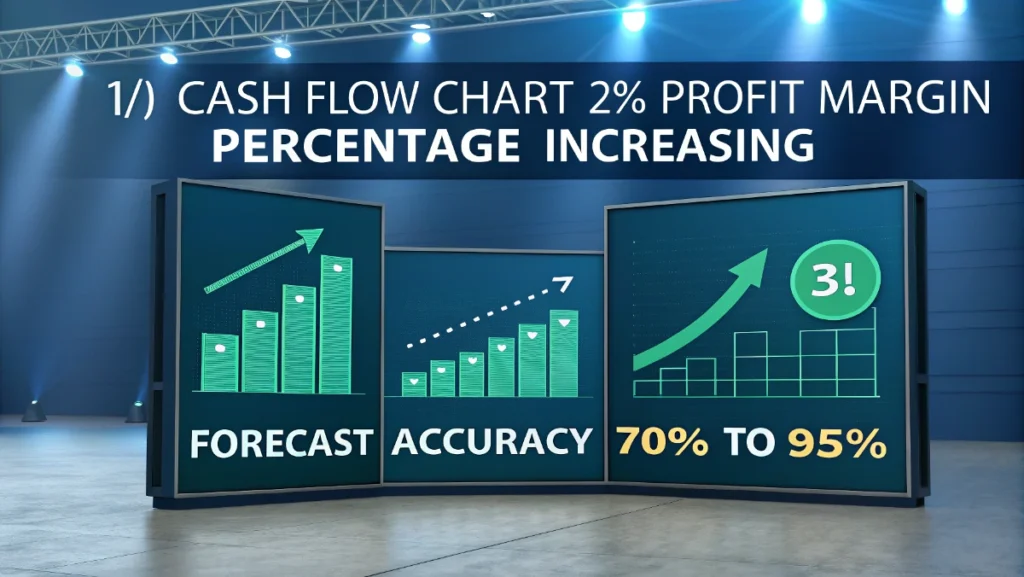

A software startup grew to $2M annual recurring revenue but couldn’t predict monthly cash accurately. Churn rates confused everyone. Forecasts missed by 30% regularly.

PedroVazPaulo overhauled their revenue tracking system completely. They implemented proper subscription metrics, cohort analysis, and churn prediction models. New dashboard showed monthly recurring revenue, customer lifetime value, and renewal probabilities clearly.

Outcome: Monthly forecast accuracy improved from 70% to 95%. The company identified which customer segments generated real profit versus vanity metrics. Series A fundraising went smoothly with clean, investor-ready financials.

E-Commerce Brand: Seasonal Cash Crunch

An online retailer faced massive inventory challenges. They over-ordered for holiday seasons, creating cash crunches every spring. Stockouts during peak periods killed revenue potential.

PedroVazPaulo created a 13-week rolling cash forecast tied to inventory levels and seasonal patterns. They renegotiated supplier payment terms, extending payments from 30 to 60 days. The new system balanced inventory investment against cash availability dynamically.

Outcome: Cash flow stabilized across all seasons. Stockouts dropped 80%. The business freed up $150,000 in working capital previously trapped in excess inventory.

Founder Preparing Series A

A solo founder built solid traction but had messy financials. Historical records lived across multiple spreadsheets. Revenue recognition methods changed quarterly. Investors would tear the numbers apart instantly.

PedroVazPaulo polished everything to institutional quality. They reconstructed 24 months of historical financials using consistent methodologies. Forecasts included sensitivity analysis showing best-case, expected, and conservative scenarios. Pitch deck financials told a compelling growth story backed by solid unit economics.

Outcome: The founder raised $3M Series A. Investors specifically praised financial transparency and forecast quality during due diligence.

These transformations demonstrate why pedrovazpaulo financial consulting within 20 mi or remote still delivers exceptional value. The approach works regardless of location because methodology trumps proximity.

Integration across services including pedrovazpaulo crypto investment for businesses exploring blockchain opportunities creates comprehensive support ecosystems.

Preparing Your Business for Consulting Success

Maximum value comes from proper preparation. Start gathering materials before your first consultation.

Essential Financial Documents

Compile these items immediately:

- Monthly financial statements for past 24 months minimum

- Current year budgets and forecasts

- Cash flow statements and projections

- All loan agreements and credit facilities

- Payroll details including contractor arrangements

- Past investor pitch decks if applicable

Organize everything digitally. Shared folders work better than email attachments. Clean data accelerates analysis dramatically.

Identify Your Financial Pain Points

Get specific about problems. “We need better financials” helps nobody. Instead:

- “We can’t predict cash needs beyond 30 days”

- “Our per-customer costs seem wrong but we can’t pinpoint why”

- “Investors keep asking questions we can’t answer confidently”

Clear problem statements help consultants focus immediately on highest-impact areas.

Assign a Point Person

Consultants need a dedicated contact for questions and decisions. This person should:

- Understand your business operations thoroughly

- Have authority to make financial decisions

- Respond to requests within 24-48 hours

- Coordinate input from other team members

Slow responses kill momentum. Fast communication accelerates progress exponentially.

Set Leadership Expectations

Brief your executive team about the engagement. Explain the process, timeline, and required participation. Financial transformation demands involvement from leadership, not just finance staff.

Executive buy-in ensures recommendations actually get implemented. Without it, consulting deliverables collect digital dust.

Define Success Metrics Together

Before work begins, agree on measurable outcomes. What specific improvements justify the investment? Extend runway? Reduce costs? Improve forecast accuracy? Prepare for fundraising?

Write these metrics down. Review them regularly. Success becomes obvious when targets are explicit from the start.

Frequently Asked Questions

Making the Smart Choice for Your Business

PedroVazPaulo financial consulting transforms financial confusion into competitive advantage. You get more than advice—you build capabilities that last.

The right consulting engagement delivers measurable outcomes fast. Extended cash runway gives you breathing room. Improved margins boost valuation. Accurate forecasts enable confident decisions. Investor-ready financials open funding doors.

Remember the core differentiators: hands-on implementation, data-driven methodology, and genuine knowledge transfer. You’re not buying dependency. You’re building financial independence.

Start with a diagnostic audit. Identify your biggest financial leaks and fastest wins. Then commit to the full transformation if results warrant it.

Your competitors already use professional financial guidance. The question isn’t whether you need help—it’s whether you’ll get help before burning through your runway.

Take action now. Assess your current financial situation honestly. If you can’t predict cash needs 90 days out, you need consulting. If investor questions stump you, you need preparation. If expansion decisions terrify you, you need modeling.

Financial clarity isn’t optional anymore. It’s the foundation of sustainable growth. Choose wisely. Execute completely. Watch your business transform from financially fragile to financially formidable.

The best time to fix your finances? Before crisis forces your hand. The second best time? Right now.