How to Buy & Invest in Cryptocurrency | Your Complete 2026 Guide

Learning how to buy & invest in cryptocurrency feels overwhelming at first. Most beginners don’t know where to start or which platforms to trust.

But here’s the truth: buying your first crypto takes less than 30 minutes. This guide walks you through every step.

You’ll discover how to choose exchanges, secure your investments, and build a profitable portfolio. No technical jargon. Just practical advice that works.

Understanding How to Buy Crypto: The Essential Basics

Before spending money, understand what you’re buying. Cryptocurrency isn’t like stocks or bonds. It’s digital money that lives on blockchain networks. No government controls it. No bank manages it.

Why does this matter? You become your own bank. That’s powerful but also risky. Lost passwords mean lost money forever. No customer service can help you. This reality makes proper setup crucial.

The Different Types of Cryptocurrencies

Bitcoin leads the market as digital gold. Ethereum enables smart contracts and applications. Stablecoins maintain consistent value tied to dollars.

Major categories include:

- Store of value coins: Bitcoin, Litecoin

- Smart contract platforms: Ethereum, Solana, Cardano

- Stablecoins: USDT, USDC, DAI

- Payment tokens: XRP, Stellar

- Meme coins: Dogecoin, Shiba Inu

Each serves different purposes. Bitcoin works for long-term holding. Ethereum powers decentralized applications. Stablecoins let you park money during volatility. Understanding these differences helps choosing right cryptocurrency for your goals.

What You Need Before Your First Purchase

Getting started requires minimal setup. First, choose a reputable exchange. Second, verify your identity. Third, link a payment method. That’s it.

Most platforms accept:

- Bank account transfers (lowest fees)

- Debit cards (instant but higher fees)

- Credit cards (fast but expensive)

- PayPal or other payment apps

Identity verification takes longest. Prepare government-issued ID and proof of address. Some exchanges verify instantly. Others take 1-3 business days.

How to Buy Cryptocurrency: Step-by-Step Process

Ready to make your first purchase? Follow these exact steps. They work for any major exchange platform.

Choosing the Right Exchange Platform

Exchanges are marketplaces where you trade dollars for crypto. Picking the right one matters enormously. Security, fees, and user experience vary widely.

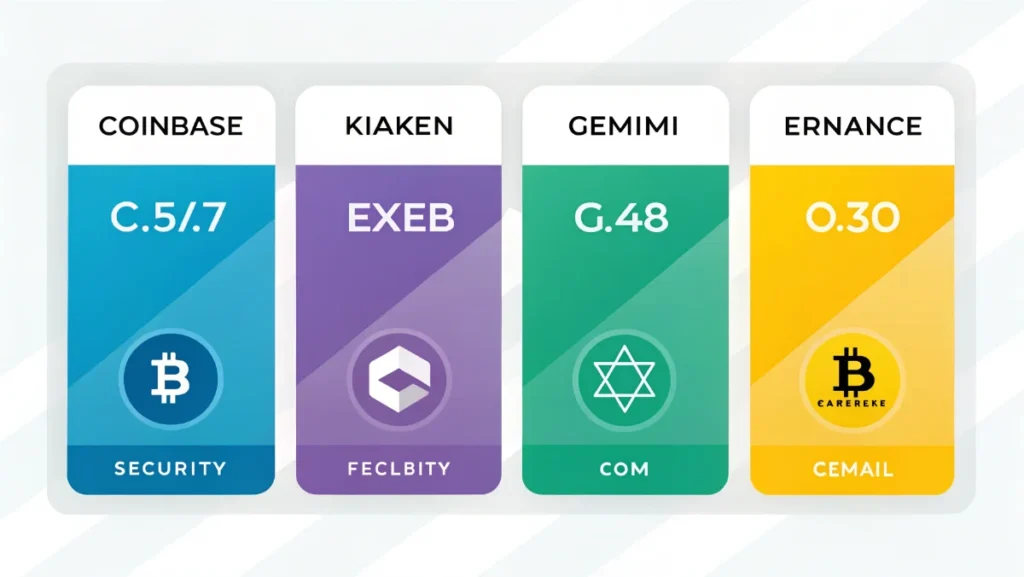

Top beginner-friendly exchanges:

| Exchange | Best For | Trading Fees | Available Coins |

|---|---|---|---|

| Coinbase | New users | 0.5-1.5% | 250+ |

| Kraken | Security | 0.16-0.26% | 200+ |

| Gemini | Regulation | 0.5-1% | 100+ |

| Binance.US | Low fees | 0.1-0.5% | 150+ |

Coinbase offers the simplest interface. Beginners love it despite higher fees. Kraken provides advanced features for serious traders. Gemini emphasizes regulatory compliance and insurance.

Consider these factors:

- Security track record (any past hacks?)

- Customer support quality and response time

- Payment methods available

- Withdrawal limits and restrictions

- Mobile app functionality

Creating and Securing Your Account

Visit your chosen exchange’s website. Click “Sign Up” or “Get Started.” Enter your email and create a strong password.

Password requirements:

- Minimum 12 characters long

- Mix uppercase and lowercase letters

- Include numbers and symbols

- Never reuse passwords from other sites

Enable two-factor authentication immediately. This adds a second security layer. Even if someone steals your password, they can’t access your account. Use Google Authenticator or Authy apps. Avoid SMS verification when possible—it’s less secure.

Completing Identity Verification (KYC)

Know Your Customer (KYC) requirements are mandatory. Exchanges must verify your identity by law. This prevents money laundering and fraud.

Upload these documents:

- Government-issued photo ID (driver’s license or passport)

- Proof of address (utility bill or bank statement)

- Selfie holding your ID (some platforms require this)

Verification usually completes within hours. Some exchanges take longer during busy periods. You can’t buy crypto until this finishes. Plan ahead if you want to purchase quickly.

How to Invest in Cryptocurrency Successfully

Buying crypto is easy. Investing profitably requires strategy. Random purchases rarely generate returns. Smart investors follow proven principles.

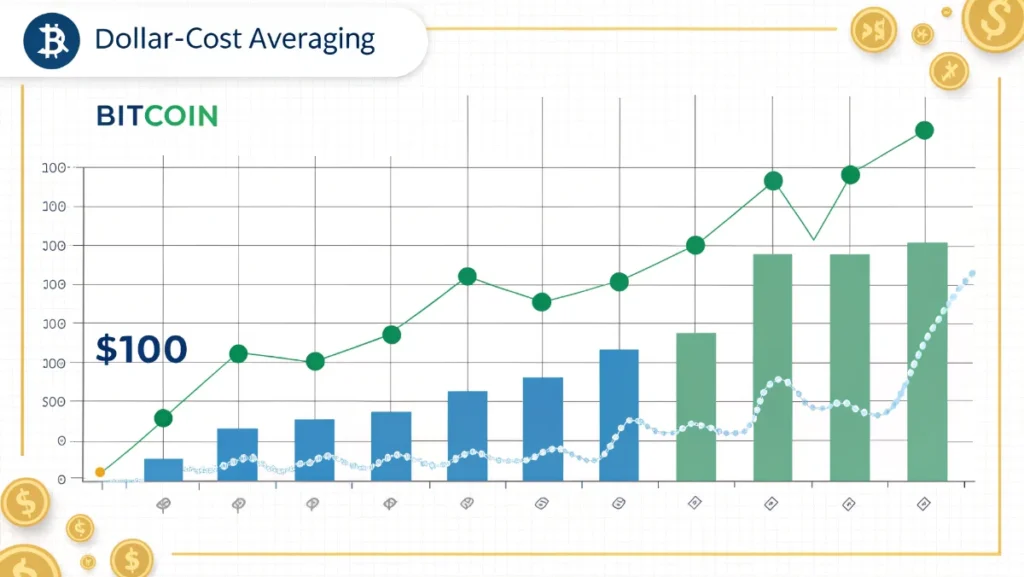

Dollar-Cost Averaging Strategy

Dollar-cost averaging (DCA) removes emotion from investing. You buy fixed amounts at regular intervals. Weekly or monthly purchases work best.

Example scenario:

- Invest $100 every week regardless of price

- Some weeks Bitcoin costs $40,000

- Other weeks it drops to $35,000

- Over time, you average out the volatility

This strategy prevents buying everything at market peaks. You accumulate more coins during dips. Less stress, better results long-term. Many successful investors swear by this approach.

Set up automatic purchases on your exchange. Most platforms offer recurring buy features. Schedule it and forget about it. Check your portfolio quarterly, not daily.

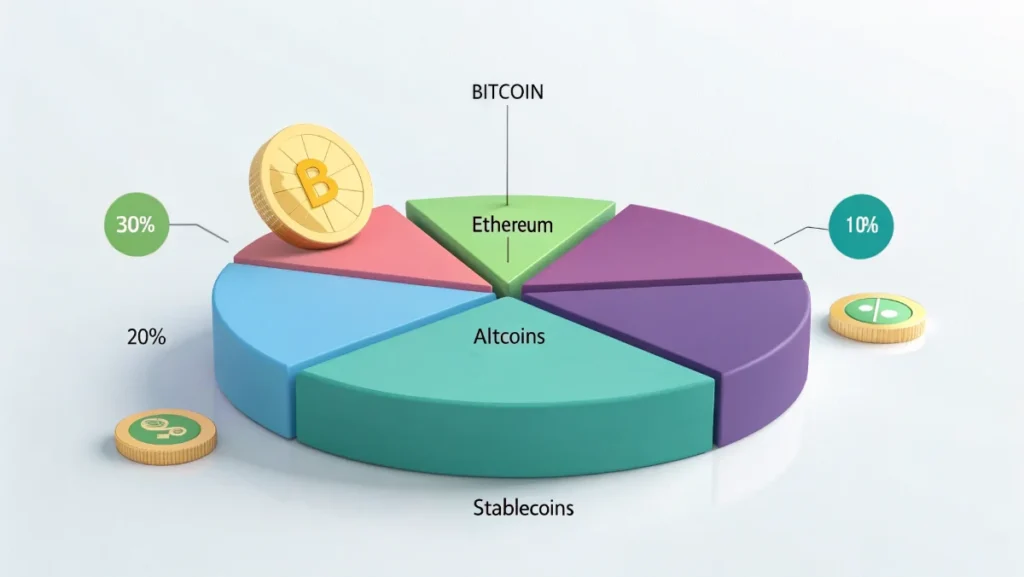

Portfolio Diversification Tactics

Never put all money into one cryptocurrency. Diversification reduces risk dramatically. If one coin crashes, others might rise.

Sample beginner portfolio allocation:

- 40% Bitcoin (established, relatively stable)

- 30% Ethereum (smart contract leader)

- 20% Top altcoins (Solana, Cardano, Polygon)

- 10% Stablecoins (USDC for opportunities)

Adjust percentages based on risk tolerance. Conservative investors hold more Bitcoin. Aggressive investors allocate more to altcoins. Rebalance quarterly to maintain target ratios.

Research before buying anything. Read whitepapers. Understand the project’s purpose. Check team credentials and community activity. For deeper insights, explore cryptocurrency fundamentals.

Understanding Market Cycles and Timing

Cryptocurrency markets move in cycles. Bull markets feature rising prices and euphoria. Bear markets bring crashes and despair. Both present opportunities.

Bull market characteristics:

- Prices increase consistently

- Mainstream media coverage intensifies

- New investors flood in

- Everyone talks about crypto

Bear market signals:

- Prices drop 50-80% from peaks

- Media declares crypto dead

- Retail investors disappear

- Fear dominates sentiment

Smart investors accumulate during bear markets. They take profits during bull runs. This contrarian approach builds wealth over time. Most people do the opposite and lose money.

Investing in Cryptocurrency: Risk Management Essentials

Crypto investing carries significant risks. Volatility can wipe out portfolios quickly. Proper risk management protects your capital.

Position Sizing and Capital Allocation

Never invest money you can’t afford to lose. This isn’t just advice—it’s mandatory for survival. Crypto remains highly speculative despite growing adoption.

Recommended allocation by experience:

- Complete beginners: 1-5% of investment portfolio

- Some experience: 5-10% of investment portfolio

- Advanced investors: 10-20% of investment portfolio

- Crypto specialists: 20%+ (understand the risks)

Start small. Increase exposure as you learn. Many beginners invest too much too quickly. Then panic sell during corrections. Proper position sizing prevents emotional decisions.

Setting Stop-Losses and Take-Profit Orders

Stop-losses automatically sell if prices drop to certain levels. They limit potential losses on every trade. Take-profit orders lock in gains automatically.

Example setup:

- Buy Bitcoin at $40,000

- Set stop-loss at $36,000 (10% loss maximum)

- Set take-profit at $48,000 (20% gain target)

Not every exchange offers these features. Check before trading. Advanced platforms provide more sophisticated order types. Beginners should master basics first before exploring complex strategies.

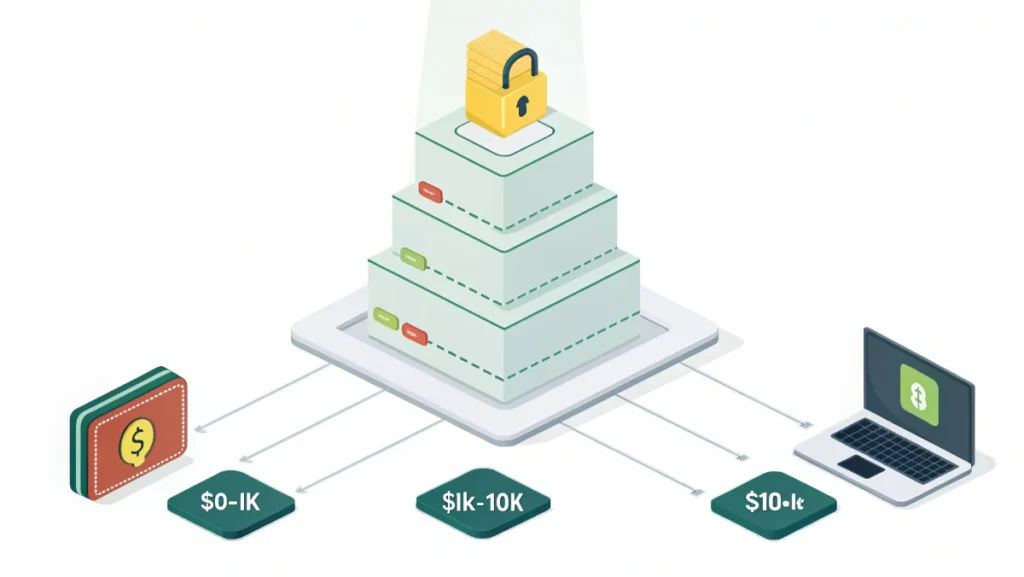

Securing Your Cryptocurrency Investments

Exchange hacks have stolen billions over the years. Mt. Gox lost 850,000 Bitcoin in 2014. Smaller hacks happen regularly. Never leave large amounts on exchanges.

Security hierarchy:

- Hot wallets: On exchanges, convenient but risky

- Software wallets: On your device, better security

- Hardware wallets: Physical devices, excellent security

- Cold storage: Offline, maximum security

For holdings under $1,000, exchange storage works fine. Between $1,000-$10,000, get a software wallet. Above $10,000, invest in hardware wallet like Ledger or Trezor. These cost $50-200 but protect your assets.

Write down recovery phrases on paper. Store them in secure locations. Never take photos or save digitally. Anyone with your recovery phrase controls your crypto.

Best Crypto to Buy Now: Making Smart Choices

Which cryptocurrencies deserve your investment? Thousands exist but most will fail. Focus on projects with real utility and adoption.

Evaluating Cryptocurrency Projects

Due diligence separates winners from losers. Don’t buy based on hype or social media tips. Research thoroughly before investing anything.

Key evaluation criteria:

| Factor | What to Check | Red Flags |

|---|---|---|

| Team | LinkedIn profiles, track record | Anonymous founders, no experience |

| Technology | Working product, unique features | Vague promises, no code |

| Community | Active development, real users | Fake followers, bot activity |

| Tokenomics | Fair distribution, clear utility | Massive founder allocation |

| Partnerships | Verified collaborations | Exaggerated claims |

Check project websites and documentation. Read whitepapers carefully. Join official communities on Discord or Telegram. Ask questions. Legitimate projects welcome scrutiny.

Beware of promises guaranteeing returns. No investment is certain. High returns always mean high risk. If something sounds too good to be true, it probably is.

Best Cryptocurrency to Invest in for Beginners

Start with established projects. Bitcoin and Ethereum dominate for good reasons. They survived multiple bear markets. They have largest network effects.

Top beginner-friendly options:

Bitcoin (BTC) – The original cryptocurrency and digital gold standard. Highest security, widest acceptance, most liquid. Perfect for long-term holding. Store of value proposition strengthens as fiat currencies inflate.

Ethereum (ETH) – Powers most decentralized applications and smart contracts. Essential for DeFi and NFT ecosystems. Major upgrade to proof-of-stake reduced energy consumption by 99%. Second safest crypto investment.

Solana (SOL) – Fast and cheap transactions attract developers. Growing ecosystem of applications. Higher risk than Bitcoin or Ethereum but significant potential. Good for small portfolio allocation.

Cardano (ADA) – Research-driven development approach. Strong academic foundation. Slower progress but methodical execution. Suitable for patient investors.

Avoid microcap coins initially. They promise huge gains but rarely deliver. Most disappear within months. Build experience with major projects first. Understanding industry-specific cryptocurrencies helps identify quality projects.

How to Get Free Crypto Legitimately

Free crypto opportunities exist everywhere. Most require minimal effort. Small amounts add up over time through compound growth.

Legitimate methods:

- Coinbase Earn: Watch educational videos, earn crypto rewards

- Brave Browser: Get paid in BAT tokens for viewing ads

- Airdrops: New projects distribute free tokens to early users

- Staking rewards: Earn interest on holdings

- Referral programs: Invite friends, both get bonuses

Be cautious with free crypto offers. Scammers use giveaways as bait. Never send crypto to receive more back. No celebrity is hosting real giveaways on Twitter. Legitimate free crypto never requires payment first.

Faucets distribute tiny amounts regularly. They’re legitimate but pay very little. Better to focus on learning and investing small amounts. Education provides better returns than chasing free pennies.

Common Mistakes When You Buy Cryptocurrency

New investors make predictable mistakes. Learn from others’ errors. Avoid these costly pitfalls.

Emotional Trading and FOMO

Fear of missing out (FOMO) destroys portfolios. Prices surge and beginners panic buy at peaks. Then markets correct and they sell at losses. This cycle repeats endlessly.

Emotional trading signs:

- Checking prices every hour

- Making decisions based on price movements

- Following random Twitter predictions

- Buying because friends are buying

- Selling in panic during dips

Combat emotion with strict rules. Decide purchase amounts and timing in advance. Stick to your plan regardless of price action. Successful investors stay calm during chaos.

Set specific goals before buying. Know your exit strategy. Determine profit targets and loss limits. Write these down. Review them before making any trades.

Falling for Scams and Fraud

The crypto space attracts scammers like honey attracts bees. Common schemes target beginners specifically. Awareness prevents most losses.

Common scam types:

- Fake exchanges stealing deposits

- Phishing emails requesting private keys

- Ponzi schemes promising guaranteed returns

- Pump and dump groups manipulating prices

- Romance scams involving crypto payments

- Fake wallet apps stealing credentials

Verify website URLs carefully. Scammers create sites nearly identical to legitimate exchanges. One letter difference can cost everything. Bookmark real sites. Always type URLs manually or use bookmarks.

Never share private keys or recovery phrases. Exchange customer support never asks for these. Anyone requesting them is scamming you. No exceptions.

Research projects on multiple sources. One positive review isn’t enough. Check Reddit, Twitter, and dedicated forums. Look for both positive and negative opinions.

Neglecting Tax Obligations

Cryptocurrency transactions trigger tax events in most countries. Trading crypto creates taxable gains or losses. Even swapping one coin for another counts.

Taxable events include:

- Selling crypto for fiat currency

- Trading one cryptocurrency for another

- Using crypto to buy goods or services

- Earning crypto through mining or staking

Track every transaction from day one. Use software like CoinTracker or Koinly. They automatically calculate gains and losses. Tax season becomes much easier with proper records.

Consult tax professionals familiar with crypto. Rules vary by country and change frequently. Professional advice prevents costly mistakes. The IRS and other tax agencies increasingly focus on crypto compliance.

Advanced Strategies for How to Buy & Invest in Cryptocurrency

Ready to level up your investing? These advanced techniques generate better returns. They also require more knowledge and experience.

Staking and Earning Passive Income

Staking lets you earn interest on cryptocurrency holdings. Similar to bank savings accounts but often with higher rates. You lock up coins to support network operations.

Popular staking options:

| Cryptocurrency | Annual Rewards | Lock-up Period | Risk Level |

|---|---|---|---|

| Ethereum | 4-5% | Flexible | Low |

| Cardano | 4-6% | None | Low |

| Polkadot | 10-12% | 28 days | Medium |

| Cosmos | 8-10% | 21 days | Medium |

Exchanges offer easy staking services. Coinbase and Kraken handle technical aspects. You just deposit and earn. They take a small commission from rewards.

Running your own validator node offers higher returns. This requires technical knowledge and equipment. Not suitable for beginners but worth exploring later. Staking provides steady income during bear markets.

Using DeFi Platforms for Higher Yields

Decentralized Finance (DeFi) offers yields higher than traditional staking. You lend cryptocurrency to borrowers. Interest rates fluctuate based on demand.

Popular DeFi platforms:

- Aave: Lending and borrowing with variable rates

- Compound: Algorithmic interest rate protocol

- Curve: Stablecoin trading with low slippage

- Uniswap: Decentralized exchange for token swaps

DeFi carries additional risks. Smart contract bugs can drain funds. No insurance protects DeFi deposits. Only use funds you can afford to lose completely.

Start with small amounts to learn. Understand how each platform works before depositing. Never invest in protocols you don’t understand. The 20% APY might hide significant risks. Businesses interested in deeper integration should explore crypto payment integration options.

Technical Analysis Basics

Technical analysis uses price charts to predict movements. Traders identify patterns that historically signal trend changes. This skill takes months to develop.

Essential concepts:

- Support levels: Prices where buying typically increases

- Resistance levels: Prices where selling pressure emerges

- Moving averages: Smooth out price data over time

- RSI indicator: Shows overbought or oversold conditions

- Volume analysis: Confirms trend strength

Learn one indicator at a time. Master it before adding another. Too many indicators create confusion and paralysis. Simple strategies often work best.

Paper trade before risking real money. Practice strategies with virtual funds. Track results honestly. Most strategies fail in real conditions. Find what works for your personality and schedule.

Building Long-Term Wealth Through Cryptocurrency

Quick profits attract most people to crypto. But real wealth comes from long-term thinking. Patience and discipline beat trading for most investors.

The HODL Philosophy Explained

HODL means holding cryptocurrency long-term regardless of price swings. The term originated from a drunken typo but became investing philosophy. HODLers ignore short-term volatility.

Why HODLing works:

- Avoids emotional trading mistakes

- Reduces transaction fees and taxes

- Benefits from long-term adoption trends

- Requires minimal time and effort

- Historically outperforms active trading

Bitcoin’s price drops 30-50% regularly. HODLers don’t panic during these corrections. They understand volatility is normal. Zoom out to see the bigger picture.

Set a time horizon of at least 4 years. This covers one full market cycle. Review holdings periodically but resist constant tinkering. The best investors do nothing most of the time.

Rebalancing Your Portfolio

Market movements change portfolio allocation over time. Assets that surge dominate your holdings. Regular rebalancing maintains target ratios.

Rebalancing process:

- Review current portfolio percentages quarterly

- Compare to target allocation

- Sell overweight positions

- Buy underweight positions

- Document changes for tax purposes

This forces selling high and buying low. Exactly what successful investing requires. Most people do the opposite naturally. Systematic rebalancing removes emotion from the equation.

Some investors rebalance only during extreme movements. If any asset exceeds 50% of portfolio, they trim it. Others stick to calendar schedules. Find what works for your situation.

Staying Informed Without Information Overload

Cryptocurrency markets move 24/7. News breaks constantly. Staying informed is important. Getting overwhelmed is easy.

Information management tips:

- Limit price checking to once daily

- Follow 3-5 trusted news sources only

- Ignore most Twitter crypto influencers

- Join quality discussion communities

- Read weekly summaries instead of real-time feeds

Quality information matters more than quantity. One good analysis beats 100 hype tweets. Curate your information sources carefully. Unfollow accounts that cause anxiety or FOMO.

Learning what is cryptocurrency fundamentals helps filter noise from signal. Focus on technology improvements and adoption metrics. Price predictions are entertainment, not analysis.

Resources for Continued Learning

Cryptocurrency evolves rapidly. Continuous education separates successful investors from failures. These resources provide quality information.

Educational Platforms and Courses

Free resources teach fundamentals effectively. Paid courses offer structured learning paths. Choose based on your learning style.

Recommended resources:

- Coinbase Learn: Free courses with crypto rewards

- Binance Academy: Comprehensive articles and videos

- Andreas Antonopoulos YouTube: Technical but accessible

- MIT OpenCourseWare: Blockchain fundamentals course

- Coursera: University-level blockchain courses

Books provide deeper understanding. “The Bitcoin Standard” explains monetary theory. “Mastering Ethereum” covers technical aspects. “The Basics of Bitcoins and Blockchains” suits beginners perfectly.

Podcasts work great for commute time. “Unchained” interviews industry leaders. “The Pomp Podcast” covers markets and adoption. “Bankless” explores Ethereum and DeFi.

Following Market Analysis Tools

Professional tools provide data-driven insights. Free versions offer sufficient features for beginners. Upgrade later if needed.

Essential tools:

- CoinGecko: Price tracking and market data

- TradingView: Advanced charting platform

- Glassnode: On-chain analytics and metrics

- CoinMarketCap: Market overviews and rankings

- DeFi Pulse: DeFi protocol statistics

Set up price alerts for investment targets. Get notified when opportunities arise. Don’t obsess over minute-to-minute changes. Focus on weekly and monthly trends instead.

For entrepreneurs considering crypto ventures, explore starting a crypto business opportunities. The industry needs builders, not just traders.

Frequently Asked Questions

Conclusion

Learning how to buy & invest in cryptocurrency doesn’t require advanced degrees. You now understand exchange selection, security practices, and portfolio building. Start small and learn continuously. Avoid emotional decisions and common scams.

Key takeaways to remember:

- Begin with reputable exchanges and major cryptocurrencies

- Dollar-cost averaging reduces timing risk effectively

- Security matters more than potential gains

- Diversification protects against individual coin failures

- Long-term thinking beats short-term trading for most

Take your first step today. Open an exchange account. Complete verification. Make a small purchase to learn the process. Knowledge grows through action, not just reading.

The cryptocurrency market rewards patience and discipline. It punishes greed and impatience. Focus on steady accumulation over quick profits. Your future self will thank you for starting today. Success in crypto comes from consistent execution over time.

For advanced strategies and deeper insights, explore PedroVazPaulo crypto investment approaches. The journey starts with a single step. Make yours count.