Ftasiastock: Your Complete Guide to Smart Technology and Market Intelligence

Ftasiastock is transforming how businesses track technology trends and market data. Many professionals struggle to find reliable, real-time information about tech markets and crypto developments. This guide shows you exactly how Ftasiastock solves that problem.

You’ll discover practical ways to use this platform. Whether you’re tracking crypto markets or analyzing business technology news, Ftasiastock delivers actionable insights. No fluff. No confusing jargon. Just clear strategies you can implement today.

The platform combines market analysis with technology reporting. It’s designed for decision-makers who need accurate data fast. By the end of this article, you’ll know how to leverage Ftasiastock for your specific needs.

What Is Ftasiastock and Why It Matters

Ftasiastock is a comprehensive technology and market intelligence platform. It tracks crypto markets, business news, and emerging tech trends. Think of it as your central hub for financial technology information.

The platform focuses on the Asia-Pacific fintech sector. This region drives global innovation in blockchain and digital finance. Understanding these markets gives you a competitive edge.

Key features include:

- Real-time crypto market tracking

- Business technology news updates

- Industry-specific trend analysis

- Management insights for tech leaders

- Cross-sector market intelligence

Many platforms offer generic market data. Ftasiastock specializes in technology-driven financial markets. This focus makes the information more relevant and actionable.

Why Traditional Market Tools Fall Short

Standard financial platforms miss crucial tech developments. They report numbers without context. Ftasiastock bridges this gap by connecting market movements to technology innovations.

The platform explains what drives price changes. You get the story behind the data. This helps you make informed decisions, not just react to numbers.

Business ftasiastock coverage includes emerging technologies like AI integration and blockchain applications. These insights help you spot opportunities before competitors do.

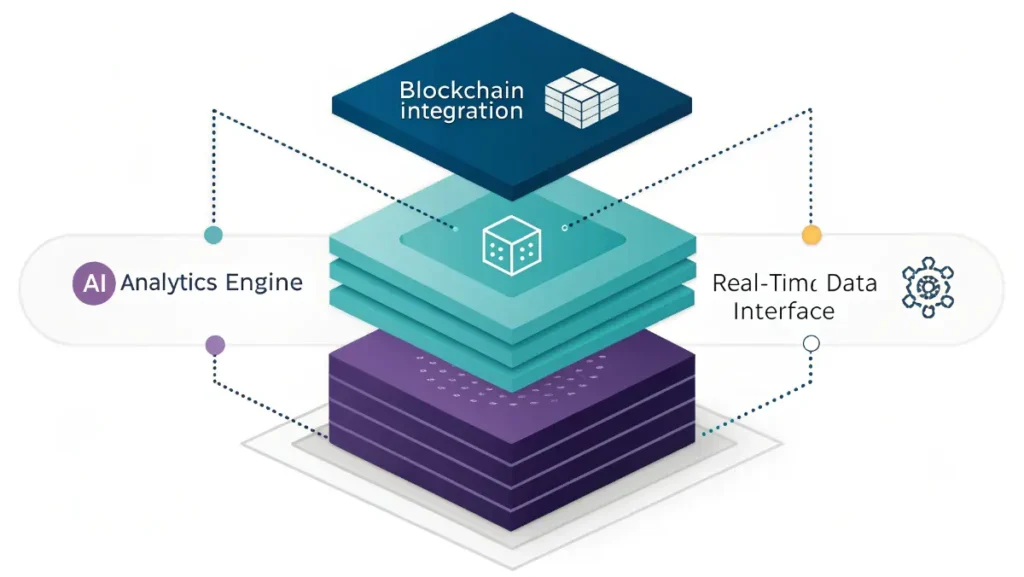

Understanding Ftasiastock Technology

Ftasiastock technology combines multiple data sources into one interface. The system aggregates news, market data, and analytical reports. Everything updates in real-time.

The architecture prioritizes speed and accuracy. Data flows from exchanges, news sources, and proprietary analysis tools. Advanced algorithms filter noise and highlight significant developments.

The technology stack includes:

- Blockchain integration for crypto tracking

- AI-powered news curation

- Machine learning for trend prediction

- Secure API connections to major exchanges

- Cloud-based scalable infrastructure

This isn’t just a news aggregator. The platform analyzes patterns and identifies correlations. For instance, it might connect a regulatory announcement to expected market movements.

How the Platform Processes Information

Ftasiastock technologies use natural language processing to scan thousands of sources. The system identifies relevant stories based on your preferences. It then categorizes information by industry, impact level, and urgency.

Users can customize their feeds. Focus on specific cryptocurrencies, business sectors, or geographic regions. The platform learns from your interactions and improves recommendations over time.

When exploring what is cryptocurrency, understanding data sources becomes essential. Ftasiastock pulls from verified exchanges and trusted news outlets. This ensures accuracy and reduces misinformation.

Integration Capabilities

The platform offers API access for advanced users. Connect Ftasiastock to your existing tools and dashboards. Pull data directly into your analytics software or trading platforms.

Integration supports major business intelligence tools. Whether you use Tableau, Power BI, or custom solutions, Ftasiastock fits your workflow. This flexibility saves time and improves decision-making.

Ftasiastock Crypto: Navigating Digital Asset Markets

Ftasiastock crypto coverage stands out from generic crypto news sites. The platform combines price tracking with technological analysis. You understand not just what’s happening, but why it matters.

Cryptocurrency markets move fast. Traditional news sources lag behind. Ftasiastock delivers real-time updates with instant analysis. This speed advantage helps traders and investors react quickly.

The platform tracks major cryptocurrencies and emerging altcoins. Coverage includes Bitcoin, Ethereum, and specialized tokens for specific industries. Each asset gets technical analysis and market sentiment assessment.

Key Features for Crypto Traders

Price alerts and notifications: Set custom triggers for price movements. Get instant notifications via email or mobile app. Never miss important market changes.

Technical analysis tools: Built-in charting shows support levels, resistance points, and trend indicators. Visual data helps identify entry and exit points.

Sentiment analysis: The platform measures market sentiment across social media and news sources. High positive sentiment often precedes price increases. Negative sentiment signals potential drops.

Regulatory tracking: Crypto regulations constantly evolve. Ftasiastock monitors government announcements and policy changes. Stay compliant and anticipate market impacts.

Understanding cryptocurrency fundamentals helps you interpret Ftasiastock’s crypto insights more effectively. The platform assumes basic knowledge but provides context for complex developments.

Industry-Specific Crypto Applications

Ftasiastock covers how different sectors adopt cryptocurrency. Healthcare organizations use blockchain for patient records. Supply chains implement crypto for transparent tracking. Retail businesses accept digital payments.

Each sector faces unique challenges and opportunities. The platform breaks down industry-specific cryptocurrencies and their practical applications. This helps you identify investment opportunities aligned with your industry knowledge.

Management Tips Ftasiastock Recommends

Management tips ftasiastock provides focus on data-driven decision-making. Leaders need accurate information to guide strategy. The platform offers frameworks for using market intelligence effectively.

Top management strategies:

- Set clear data priorities: Identify which metrics matter most to your business. Focus your Ftasiastock dashboard on these indicators.

- Create alert hierarchies: Not every market movement requires immediate action. Classify alerts by urgency and impact.

- Integrate with team workflows: Share relevant insights with department heads. Ensure everyone accesses the same accurate information.

- Review weekly patterns: Look beyond daily fluctuations. Weekly trend analysis reveals more meaningful patterns.

- Document decision rationale: Record why you made specific choices based on Ftasiastock data. This builds institutional knowledge.

Building a Data-Driven Culture

Ftasiastock management approaches emphasize organizational adoption. Technology only works when teams use it consistently. Train staff on interpreting market signals and technology trends.

Create regular review meetings focused on platform insights. Discuss how market changes affect business strategy. Encourage questions and collaborative analysis.

Leaders should model data usage. When executives reference Ftasiastock in decisions, teams follow suit. Make the platform part of your strategic vocabulary.

Risk Management Through Market Intelligence

Smart managers use ftasiastock to identify risks early. Market downturns, regulatory changes, and technology disruptions appear in data before becoming obvious. Early detection allows proactive responses.

The platform highlights volatility indicators and risk scores. Use these metrics to adjust exposure and hedge positions. Better risk management protects profits and enables sustainable growth.

Ftasiastock Business News: Staying Ahead of Trends

Ftasiastock business news delivers more than headlines. Each story includes context, analysis, and potential business implications. This transforms news consumption from passive reading to strategic intelligence gathering.

The news section organizes content by relevance and impact. High-priority stories appear prominently. Less urgent updates remain accessible but don’t clutter your feed.

News categories include:

- Mergers and acquisitions: Track consolidation in tech and fintech sectors

- Funding announcements: Identify which companies attract investment

- Product launches: Discover new technologies before competitors

- Executive changes: Understand leadership shifts and their implications

- Regulatory updates: Stay compliant and anticipate market impacts

How to Process Business News Efficiently

Scan headlines first to identify urgent developments. Dive deep into stories that directly affect your business. Bookmark others for later review. This triaging saves time while ensuring nothing critical slips through.

Ftasiastock business news includes expert commentary. Industry leaders provide perspectives on major developments. These insights help you interpret events correctly.

When starting a crypto business, staying current on regulatory news becomes essential. Ftasiastock tracks global crypto regulations and compliance requirements.

Competitive Intelligence Through News Monitoring

Track competitors mentioned in ftasiastock news by fintechasia. Set up alerts for rival companies and their key executives. Understanding competitor moves helps you anticipate market changes.

The platform reveals partnership announcements, technology adoptions, and strategic pivots. This intelligence informs your own strategic planning. Sometimes the best move is responding to a competitor’s initiative before they gain advantage.

Market Trend Ftasiastock Analysis

Market trend ftasiastock tracking reveals patterns invisible to casual observers. The platform uses historical data and current movements to project future developments. These projections help you position your business advantageously.

Trends appear across multiple timeframes. Short-term trends (days to weeks) affect tactical decisions. Medium-term trends (months) guide operational adjustments. Long-term trends (quarters to years) inform strategic planning.

Key trend indicators:

| Indicator | What It Measures | How to Use It |

|---|---|---|

| Price momentum | Speed of market movements | Identifies acceleration or deceleration |

| Volume trends | Trading activity levels | Confirms price movement validity |

| Sentiment shifts | Market psychology changes | Predicts potential reversals |

| Correlation patterns | Asset relationship changes | Diversifies portfolio risk |

| Regulatory momentum | Policy direction trends | Anticipates compliance needs |

Interpreting Trend Data

Ftasiastock market trends from fintechasia provide visual dashboards. Charts show trend strength, direction, and sustainability. Green indicators suggest bullish trends. Red indicates bearish movements. Yellow signals uncertainty or transition periods.

Don’t react to every small fluctuation. Focus on trends that persist across multiple days. Sustained movements carry more predictive power than brief spikes.

The platform also highlights trend reversals. When long-standing patterns break, significant market changes often follow. These reversal alerts deserve immediate attention.

Cross-Market Correlation Analysis

Understanding how different markets interact improves decision-making. Ftasiastock tracks correlations between crypto markets, stock indices, and commodity prices. These relationships reveal hidden risks and opportunities.

For example, when traditional markets decline, crypto sometimes moves inversely. Other times they correlate closely. The platform shows current correlation strength. This helps you diversify effectively.

When considering how to buy and invest in cryptocurrency, understanding broader market correlations reduces risk exposure.

Ftasiastock Technology News: Innovation Updates

Ftasiastock technology news covers breakthrough innovations and incremental improvements. Both matter for different reasons. Breakthroughs create new opportunities. Incremental changes compound into competitive advantages.

The technology news section organizes content by industry application. Filter for retail tech, financial services innovation, healthcare technology, or manufacturing automation. This targeted approach saves time and increases relevance.

Technology coverage areas:

- Artificial intelligence and machine learning applications

- Blockchain beyond cryptocurrency

- Internet of Things (IoT) implementations

- Cybersecurity developments

- Cloud computing innovations

- Quantum computing progress

Practical Technology Adoption

Reading about technology isn’t enough. Ftasiastock news by fintechasia includes implementation guides and case studies. Learn how companies successfully adopted new technologies.

Each technology article answers critical questions. What problem does this solve? What’s the implementation cost? How long until return on investment? What are the risks?

This practical focus helps you evaluate technologies objectively. Not every innovation fits your business. The platform helps identify which ones matter for your specific situation.

Monitoring Technology Risks

New technologies introduce vulnerabilities and dependencies. Ftasiastock tracks security issues, compatibility problems, and failed implementations. Learning from others’ mistakes prevents costly errors.

The platform reports zero-day vulnerabilities and patches. Cybersecurity updates arrive immediately. This allows rapid response to protect your systems.

Comparing Ftasiastock to Alternative Platforms

Understanding how ftasiastock stacks up against competitors helps you choose the right tool. Different platforms serve different needs. Here’s an honest comparison:

| Feature | Ftasiastock | Bloomberg | CoinMarketCap | TechCrunch |

|---|---|---|---|---|

| Crypto focus | High | Medium | Very High | Low |

| Tech news | High | Medium | Low | Very High |

| Business analysis | High | Very High | Low | Medium |

| Real-time data | Yes | Yes | Yes | No |

| Price point | Moderate | Premium | Free/Paid | Free |

| Asia-Pacific focus | Very High | Medium | Medium | Low |

When to Choose Ftasiastock

Ftasiastock excels for businesses focused on technology and crypto markets. If you need deep fintech insights with Asian market emphasis, it’s ideal. Companies expanding into Asia-Pacific markets benefit most.

The platform suits mid-size to large enterprises. Small businesses might find simpler tools adequate. However, growth-focused startups should consider Ftasiastock early. The intelligence advantage accelerates scaling.

Traditional financial institutions often prefer Bloomberg. Tech startups lean toward Ftasiastock. Crypto-native companies might use both platforms for comprehensive coverage.

Integration with Existing Tools

Most businesses use multiple information sources. Ftasiastock complements rather than replaces specialized tools. Use it alongside accounting software, CRM systems, and project management platforms.

The API enables custom integrations. Pull specific data feeds into your proprietary systems. This flexibility prevents information silos and improves organizational efficiency.

Advanced Ftasiastock Features and Best Practices

Ftasiastock offers advanced features beyond basic news and data. Power users leverage these tools for competitive advantages. Here’s how to maximize platform value:

Custom dashboard creation: Build personalized views showing only relevant information. Arrange widgets by priority. Color-code sections for quick scanning.

Historical data analysis: Access years of archived data. Identify long-term trends and cyclical patterns. Historical context improves current decision-making.

Collaborative features: Share insights with team members. Add annotations to charts and articles. Create shared watchlists for coordinated monitoring.

Automated reporting: Schedule weekly or monthly reports emailed to stakeholders. Summarize key developments without manual compilation. This ensures consistent communication.

Optimizing Your Workflow

Start each day reviewing overnight developments. Ftasiastock highlights what changed while you slept. This 5-minute routine keeps you current.

Set up smart alerts that filter noise. Only notify for significant movements exceeding your thresholds. Too many alerts create fatigue and reduce responsiveness.

Block time weekly for deep analysis. Don’t just react to daily news. Look for patterns and emerging trends. This strategic thinking separates leaders from followers.

Training Your Team

Successful Ftasiastock adoption requires team training. Schedule hands-on sessions demonstrating key features. Focus on tools relevant to each role.

Marketing teams need different data than finance departments. Customize training to show role-specific applications. This increases adoption rates and value realization.

Create internal documentation showing your company’s best practices. Record common questions and solutions. This reduces support burden and improves self-sufficiency.

Ftasiastock for Different Business Sectors

Different industries use ftasiastock differently. Retail, manufacturing, healthcare, and financial services each have unique needs. Here’s sector-specific guidance:

Financial Services Applications

Banks and investment firms track regulatory changes closely. Ftasiastock provides early warnings about policy shifts. This enables proactive compliance adjustments.

Asset managers use the platform for portfolio optimization. Correlation data helps balance risk exposure. Technology news reveals investment opportunities in emerging sectors.

For those exploring pedrovazpaulo crypto investment strategies, ftasiastock offers the market intelligence needed for informed decisions.

Retail and E-Commerce

Retailers monitor payment technology innovations. Ftasiastock covers crypto payment integration developments. Early adoption of new payment methods attracts tech-savvy customers.

The platform tracks consumer technology trends. Understand which devices and platforms your customers use. This informs app development and digital strategy.

Healthcare and Life Sciences

Healthcare organizations face strict regulations. Ftasiastock monitors compliance requirements across jurisdictions. This prevents costly violations and enables international expansion.

Medical device manufacturers track technology approvals and standards. The platform covers IoT applications in healthcare. These insights guide product development priorities.

Manufacturing and Supply Chain

Manufacturers use ftasiastock to monitor supply chain technologies. Blockchain tracking solutions improve transparency. IoT sensors enable predictive maintenance.

The platform covers industrial automation advances. Learn about robotics, AI quality control, and smart factories. These technologies reduce costs and improve quality.

Security and Privacy on Ftasiastock

Data security concerns everyone using digital platforms. Ftasiastock implements robust protection measures. Understanding these safeguards builds confidence.

Security features include:

- End-to-end encryption for data transmission

- Multi-factor authentication for account access

- Regular security audits by third-party firms

- GDPR compliance for European users

- SOC 2 Type II certification

- Isolated data storage preventing cross-contamination

Protecting Your Account

Enable all available security features. Use strong, unique passwords. Rotate credentials quarterly. Never share login details, even with colleagues.

Review account activity regularly. Ftasiastock logs all access attempts. Unusual patterns might indicate unauthorized access. Report suspicious activity immediately.

Configure session timeouts appropriately. Balance security with usability. Shorter timeouts increase security but reduce convenience.

Data Privacy Policies

Ftasiastock doesn’t sell user data to third parties. The platform generates revenue through subscriptions, not data monetization. This alignment protects your information.

You control what data the platform collects. Opt out of non-essential tracking. Delete your account anytime with full data removal guaranteed.

The platform clearly explains data usage in plain language. No hidden clauses or vague terms. This transparency builds trust and ensures informed consent.

Pricing and Subscription Options

Ftasiastock offers tiered pricing matching different business needs. Understanding options helps you choose cost-effectively.

Subscription tiers:

| Plan | Monthly Cost | Key Features | Best For |

|---|---|---|---|

| Basic | $49 | Real-time news, basic alerts | Individual professionals |

| Professional | $149 | Advanced analytics, API access | Small teams |

| Enterprise | Custom | Unlimited users, custom integration | Large organizations |

| Trial | Free | 14-day full access | Evaluation purposes |

Maximizing Subscription Value

Start with the trial period. Test all features thoroughly. Involve team members who’ll use the platform daily. Their feedback determines the right tier.

Professional plans suit most mid-size businesses. The features justify the cost through improved decision-making. Track decisions influenced by ftasiastock insights. Calculate ROI based on outcomes.

Enterprise plans make sense for organizations with 50+ users. Volume discounts offset higher base costs. Custom integrations streamline workflows significantly.

Annual vs Monthly Billing

Annual subscriptions offer 15-20% discounts. Commit annually if you’re confident in long-term usage. Monthly billing provides flexibility for testing and evaluation.

Some companies start monthly then switch to annual. This approach minimizes initial risk while securing discounts later. Negotiate with sales teams for custom arrangements.

Future Developments and Roadmap

Ftasiastock continuously evolves based on user feedback and market needs. Upcoming features address current limitations and expand capabilities.

Planned enhancements include:

- Enhanced AI predictions for market movements

- Blockchain-based content verification

- Expanded regional coverage beyond Asia-Pacific

- Mobile app improvements with offline capabilities

- Virtual reality data visualization options

Community Feature Requests

Users vote on proposed features. High-demand capabilities get priority development. This democratic approach ensures the platform serves actual needs.

Submit feature requests through the platform’s feedback system. Detailed explanations increase approval chances. Developers review submissions quarterly.

Active community forums discuss use cases and workflows. Participate to learn from peers. Share your successes to help others optimize their usage.

Staying Current with Updates

Ftasiastock releases updates monthly. Most changes deploy automatically. Major feature releases include tutorial videos and documentation.

Subscribe to the changelog newsletter. Brief summaries explain what changed and why. This keeps you informed without overwhelming detail.

Test new features in sandbox environments before production use. This prevents workflow disruptions while ensuring smooth transitions.

Common Challenges and Solutions

Even excellent platforms present occasional difficulties. Here are common ftasiastock challenges with practical solutions:

Information overload: Too many alerts create fatigue. Solution: Refine alert thresholds. Focus on high-impact events only. Review settings monthly.

Data interpretation: Complex analytics confuse non-technical users. Solution: Complete training modules. Start with basic features. Gradually adopt advanced tools as comfort increases.

Integration complexity: Connecting to existing systems requires technical expertise. Solution: Use built-in connectors for popular platforms. Hire developers for custom integrations.

Cost justification: Executives question subscription value. Solution: Document specific decisions improved by platform insights. Quantify financial impacts. Present quarterly ROI reports.

Getting Support

Ftasiastock provides multiple support channels. Email support responds within 24 hours. Live chat offers immediate assistance during business hours.

The knowledge base contains hundreds of articles. Search before contacting support. Most questions have documented solutions. Video tutorials demonstrate complex procedures.

Professional and Enterprise plans include dedicated account managers. Schedule regular check-ins to optimize usage. Managers share best practices from similar organizations.

Integrating Ftasiastock with Investment Strategy

Smart investors combine ftasiastock intelligence with established investment frameworks. The platform supplements rather than replaces fundamental analysis.

When considering choosing right cryptocurrency for investment, ftasiastock provides the market data needed for informed decisions. Combine this with technical analysis and risk assessment.

Investment integration steps:

- Define investment thesis: Establish clear criteria before consulting data. Prevent confirmation bias by deciding standards first.

- Use ftasiastock for validation: Check if market conditions support your thesis. Look for contradicting signals that warrant reconsideration.

- Monitor ongoing positions: Track relevant news and trends for current holdings. Set alerts for significant developments.

- Document decisions: Record why you bought or sold based on platform insights. Review periodically to improve strategy.

- Diversify information sources: Don’t rely solely on one platform. Cross-reference critical decisions with multiple sources.

Risk Assessment Framework

Ftasiastock data feeds into comprehensive risk models. Volatility indicators, correlation metrics, and sentiment analysis contribute to risk scores.

Calculate position sizes based on risk scores. Higher-risk assets deserve smaller allocations. This disciplined approach protects capital during downturns.

Rebalance portfolios when ftasiastock highlights major market shifts. Proactive adjustments prevent panic selling during corrections.

Learning Resources and Continued Education

Mastering ftasiastock requires ongoing learning. The platform offers extensive educational resources beyond basic tutorials.

Available learning materials:

- Webinar series covering advanced features

- Case study library showing real-world applications

- Certification program for power users

- Industry-specific guides and whitepapers

- Interactive workshops and live training sessions

Building Expertise Systematically

Create a learning schedule covering one new feature weekly. Consistent practice builds proficiency faster than sporadic intensive sessions.

Join user groups focused on your industry. Share challenges and solutions with peers. Collaborative learning accelerates skill development.

Attend annual user conferences if budget permits. Networking with other professionals reveals innovative use cases. These connections provide ongoing support beyond formal training.

Staying Updated on Industry Trends

Ftasiastock expertise extends beyond the platform itself. Understanding broader fintech and technology trends improves interpretation of platform data.

Follow key industry influencers and thought leaders. Read quarterly reports from major financial institutions. Attend webinars on emerging technologies.

When exploring opportunities like cryptocurrency pi network, broader industry knowledge helps evaluate legitimacy and potential.

Frequently Asked Questions

Conclusion: Maximizing Ftasiastock for Business Success

Ftasiastock provides the market intelligence and technology insights needed for competitive advantage. The platform combines real-time data, expert analysis, and practical tools in one accessible interface.

You’ve learned how to navigate crypto markets using ftasiastock crypto features. Management tips ftasiastock offers help you build data-driven decision frameworks. Business news keeps you ahead of industry developments.

Key takeaways:

- Start with clear objectives for using ftasiastock

- Customize dashboards and alerts to your specific needs

- Integrate platform insights into existing workflows

- Train your team systematically for maximum adoption

- Review and adjust settings regularly as needs evolve

Success requires consistent platform usage. Don’t just check ftasiastock during crises. Make it part of your daily routine. Regular monitoring reveals opportunities competitors miss.

Take action today. Start your free trial if you haven’t already. Existing users should review their current setup. Are you using all relevant features? Could better configuration improve results?

The business landscape changes rapidly. Ftasiastock helps you stay ahead. Combine platform intelligence with sound strategy. This combination drives sustainable growth and competitive advantage.

Your next step: Log into ftasiastock and implement one new feature this week. Small improvements compound into significant advantages over time.