Crypto Payment Integration: Complete Guide for 2026

Crypto payment integration transforms how businesses accept money online. Many store owners struggle with high fees and slow international transfers. The solution? Digital currency payments that settle in minutes, not days.

This isn’t just theory anymore. Real businesses are cutting costs and reaching new customers. You’ll discover exactly how to add crypto payments to your platform. No technical jargon. Just practical steps that work.

What Is Crypto Payment Integration?

Crypto payment integration connects your online store to blockchain networks. Customers can pay with Bitcoin, Ethereum, or stablecoins. The process happens through secure APIs and payment gateways.

Think of it like adding a credit card processor. But instead of Visa or Mastercard, you’re accepting digital assets. The technology handles conversion, security, and settlement automatically.

Why Businesses Choose Digital Currency Payments

Traditional payment systems cost money. Credit card fees eat 2-3% of every sale. Wire transfers take days and charge $25-50 per transaction.

Blockchain payments change the game. Fees drop to under 1% in most cases. Money moves in minutes globally. No chargebacks means less fraud risk.

Plus, you tap into a growing market. Millions hold crypto but can’t spend it easily. Your store becomes their solution.

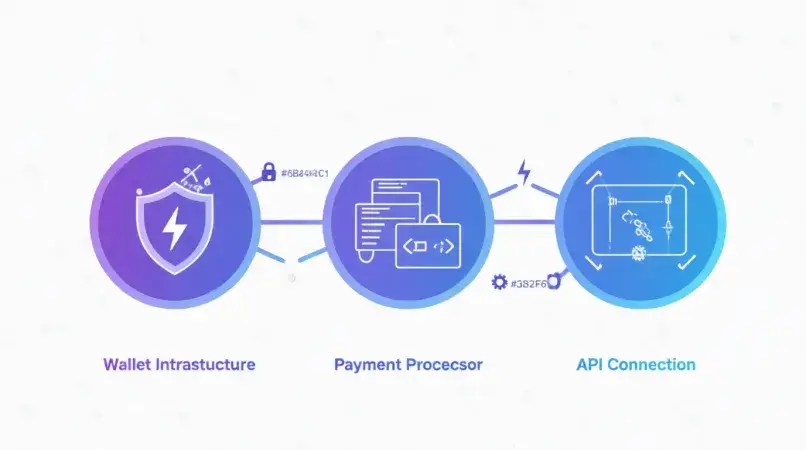

Core Components of Payment Systems

Every crypto payment integration needs three elements:

Wallet Infrastructure – Stores digital assets securely. Your business wallet receives payments from customers.

Payment Processor – Converts crypto to your preferred currency. Handles exchange rates and settlement timing.

API Connection – Links your website to the blockchain network. Processes transactions and confirms payments.

These pieces work together seamlessly. Customers click “pay with crypto” and complete checkout. You receive funds in your chosen currency.

Seamless Crypto Payment Integration for Your Platform

Integration doesn’t require blockchain expertise. Modern tools make setup straightforward. You choose your platform and follow specific steps.

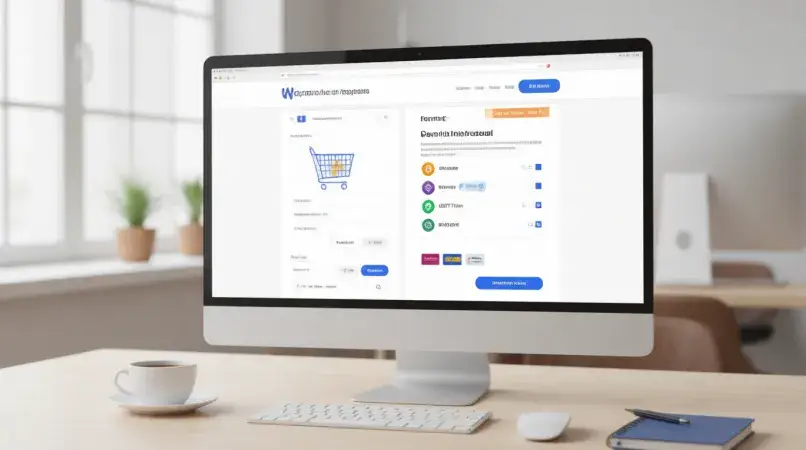

WooCommerce Crypto Payment Integration

WooCommerce powers millions of online stores. Adding crypto takes about 30 minutes with the right plugin.

First, install a payment gateway plugin. Popular options include CoinGate and BitPay. Both offer free versions to start.

Next, create an account with the gateway provider. They’ll give you API keys. Copy these into your WooCommerce settings.

Finally, enable the payment method. Customers will see crypto options at checkout. Test with a small transaction first.

Key Benefits for WooCommerce:

- Works with existing themes

- No coding knowledge required

- Supports multiple cryptocurrencies

- Automatic currency conversion

Shopify Crypto Payment Integration

Shopify makes setup even simpler. The platform supports crypto through approved apps. Installation takes minutes.

Browse the Shopify App Store for payment processors. Look for high ratings and recent updates. Install your chosen app directly.

Connect your business wallet address. The app handles technical details. You decide which coins to accept.

Enable the payment method in your checkout settings. Shopify automatically adds it to payment options. Customers select crypto like any other method.

Magento Crypto Payment Integration

Magento serves enterprise-level stores. Integration requires more technical setup but offers greater control.

Download an extension from the Magento Marketplace. Choose established providers with good support. Install through your admin panel.

Configure payment settings for each cryptocurrency. Set conversion preferences and settlement options. Test in sandbox mode before going live.

Advanced users can customize checkout flows. Match your brand experience perfectly. Business consulting services can help optimize implementation.

OpenCart Crypto Payment Integration

OpenCart offers flexibility for custom stores. Multiple payment extensions exist for different needs.

Access the Extensions marketplace. Filter for cryptocurrency payment options. Download your preferred solution.

Upload the extension files to your server. Follow installation instructions carefully. Most require simple file placement.

Activate through your OpenCart admin. Configure API credentials and wallet addresses. Set your preferred cryptocurrencies.

Blockchain Crypto Payment Integration Technical Details

Understanding the technology helps you make better decisions. You don’t need to be an engineer. Just grasp the basics.

How Blockchain Transactions Work

A customer initiates payment from their wallet. The transaction broadcasts to the blockchain network. Miners or validators confirm the transaction.

Your payment processor detects the confirmed transaction. They credit your account and handle conversion. The entire process takes 5-15 minutes typically.

Stablecoins settle even faster. They offer price stability too. No volatility risk during the payment window.

Security Considerations

Blockchain transactions are irreversible. This eliminates chargeback fraud completely. But it also means mistakes can’t be undone.

Use multi-signature wallets for large amounts. Require multiple approvals before moving funds. This protects against unauthorized access.

Enable two-factor authentication everywhere. Use hardware wallets for cold storage. Keep only necessary amounts in hot wallets.

Regular security audits prevent problems. Update software immediately when patches release. Operations consulting can establish security protocols.

Smart Contract Integration

Smart contracts automate complex payment logic. They execute automatically when conditions are met. This enables advanced business models.

Subscription services benefit greatly. Smart contracts handle recurring billing automatically. No manual intervention needed.

Escrow arrangements become simpler. Funds release when both parties confirm delivery. Disputes decrease significantly.

Loyalty programs integrate seamlessly. Customers earn tokens with every purchase. Tokens unlock special benefits automatically.

Crypto Payment Integration Tools for Developers

Developers need reliable tools and documentation. The right resources speed up implementation dramatically.

Essential APIs and SDKs

Coinbase Commerce API – Well-documented and beginner-friendly. Supports multiple languages including Python and JavaScript. Free to use with standard transaction fees.

BitPay API – Enterprise-grade features and reliability. Excellent uptime and customer support. Integrates with major accounting software.

NOWPayments API – Accepts 200+ cryptocurrencies. Flexible settlement options. Competitive fee structure.

Each API provides sandbox environments. Test thoroughly before production deployment. Documentation includes code examples and tutorials.

Development Best Practices

Start with a test network first. Ethereum’s Goerli or Bitcoin’s testnet work perfectly. Verify all functionality before mainnet deployment.

Implement proper error handling. Network issues happen occasionally. Your code should retry failed transactions gracefully.

Log every transaction detail. Include timestamps, amounts, and wallet addresses. This simplifies troubleshooting and accounting.

Build conversion rate buffers. Cryptocurrency prices fluctuate. Lock rates for 10-15 minutes during checkout.

Testing and Quality Assurance

Create comprehensive test scenarios. Cover successful payments, failed transactions, and timeout situations. Test with small amounts initially.

Verify conversion accuracy. Compare your rates with market prices. Ensure customers aren’t overcharged or undercharged.

Test on multiple devices and browsers. Mobile optimization matters significantly. Most crypto users trade on phones.

Monitor transaction speeds during peak times. Some networks slow down when congested. Plan for alternative routing if needed.

Crypto Payment Integration Services Comparison

Choosing the right service provider impacts your success. Different platforms serve different business needs.

| Service | Best For | Fees | Cryptocurrencies | Settlement Time |

|---|---|---|---|---|

| Coinbase Commerce | Small businesses | 1% | 10+ major coins | Instant to crypto wallet |

| BitPay | Enterprises | 1% | Bitcoin, BCH, ETH | Next day bank deposit |

| CoinGate | E-commerce | 1% | 70+ coins | Instant or daily |

| NOWPayments | High volume | 0.5% | 200+ coins | Daily |

| BTCPay Server | Privacy-focused | Self-hosted (free) | Bitcoin, Lightning | Immediate |

Each service offers unique advantages. Evaluate based on your specific requirements.

Fee Structure Analysis

Transaction fees vary significantly. Some charge flat percentages, others use tiered pricing. High-volume businesses negotiate better rates.

Consider hidden costs too. Currency conversion fees add up. Some providers charge monthly subscription fees.

Calculate total cost of ownership. Include setup time and maintenance. Cheaper isn’t always better long-term.

Marketing consulting can analyze which option maximizes profitability for your business model.

Settlement Options

Instant Crypto Settlement – Receive coins directly. You manage price risk and conversion. Best for crypto-native businesses.

Daily Fiat Conversion – Provider converts to USD or EUR automatically. Deposits arrive next business day. Eliminates volatility exposure.

Hybrid Approach – Keep a percentage in crypto, convert the rest. Balances risk and opportunity. Flexible based on market conditions.

Choose based on your comfort with cryptocurrency holdings. Many start with full conversion and adjust later.

Telegram Bot Crypto Payment Integration

Telegram bots offer unique payment opportunities. They combine messaging with commerce seamlessly.

Building a Payment Bot

Start with the BotFather to create your bot. Get your bot token for API access. This takes two minutes.

Choose a crypto payment API that supports Telegram. Most major providers offer Telegram-specific documentation. Integration is straightforward.

Implement payment commands users understand. “/pay”, “/donate”, or “/subscribe” work well. Keep commands simple and intuitive.

Handle payment confirmations properly. Send receipt messages automatically. Include transaction hashes for verification.

Use Cases for Bot Payments

Digital Content Sales – Sell courses, guides, or templates. Instant delivery after payment confirmation. No website required.

Subscription Services – Manage recurring payments through bot commands. Users renew with a simple message. Cancellation is equally easy.

Donation Collection – Content creators accept tips easily. Fans send crypto directly through chat. Lower fees than traditional platforms.

Group Access – Charge for premium Telegram groups. Bot verifies payment and adds users. Removes members when subscriptions expire.

Security for Bot Payments

Never store wallet private keys in your bot. Use payment processors that handle custody. Your bot only triggers payment requests.

Validate all webhook notifications. Confirm transactions on-chain before delivering products. Prevents fake payment notifications.

Rate-limit payment commands. Prevents spam and abuse attempts. Implement user verification for large amounts.

Crypto Payment Integration Checklist

Follow this systematic approach. Skip steps and problems multiply.

Pre-Launch Requirements

Legal Compliance

- Research regulations in your jurisdiction

- Obtain necessary licenses if required

- Implement KYC/AML procedures

- Consult legal counsel for gray areas

Technical Setup

- Choose payment processor

- Create business wallet

- Install integration tools

- Configure security settings

Business Preparation

- Train customer support staff

- Create crypto payment FAQs

- Design user-friendly checkout flow

- Plan for price volatility scenarios

Launch Phase

Start with a soft launch. Enable crypto payments for a small customer segment. Monitor closely for issues.

Announce the feature gradually. Use email, social media, and website banners. Explain benefits clearly to customers.

Offer launch incentives. Small discounts for crypto users encourage adoption. Build momentum early.

Track metrics carefully. Monitor conversion rates, transaction volumes, and customer feedback. Adjust based on data.

Post-Launch Optimization

Review transaction data weekly. Identify patterns and problems. Address friction points immediately.

Survey crypto-paying customers. Ask about their experience. Use feedback to improve processes.

Test new cryptocurrencies periodically. User preferences evolve. Stay current with market trends.

Update security protocols regularly. New threats emerge constantly. Coaching services can help maintain best practices.

Seamless Crypto Payment Integration for Casinos

Online gaming platforms face unique challenges. Crypto solves many traditional payment problems.

Why Casinos Adopt Crypto

Gambling payments often face banking restrictions. Many processors refuse gaming transactions. Crypto bypasses these limitations entirely.

International players struggle with currency conversion. Crypto eliminates exchange rate uncertainty. Players know exactly what they’re depositing.

Faster withdrawals increase player satisfaction. Crypto payouts process in hours, not days. This competitive advantage attracts serious players.

Implementation for Gaming

Integrate stablecoin deposits first. Tether and USDC offer price stability. Players manage bankrolls easily without volatility concerns.

Set up automatic conversion systems. Convert deposits to house currency immediately. Protects against market fluctuations.

Implement instant withdrawal processing. Manual review small amounts only. Automate large percentages of cashouts.

Design loyalty programs around tokens. Reward players with platform-specific coins. Create additional engagement opportunities.

Regulatory Considerations

Gaming regulations vary dramatically worldwide. Research requirements thoroughly before implementing. Some jurisdictions ban crypto gambling entirely.

Implement robust age verification. Blockchain doesn’t automatically verify users. Add identity checks at registration.

Maintain detailed transaction records. Regulators require comprehensive audit trails. Blockchain provides immutable records naturally.

Partner with compliant payment processors. They handle regulatory requirements professionally. Reduces your compliance burden significantly.

Crypto Payment Integration Partnership Opportunities

Strategic partnerships accelerate growth. The right alliances open new markets.

Types of Partnership Models

Affiliate Programs – Earn commissions promoting payment processors. 1-3% of transaction volume typically. Passive income for content creators.

Reseller Agreements – White-label payment solutions. Offer crypto processing under your brand. Higher margins but more responsibility.

Technology Integrations – Combine complementary services. Payment processor plus accounting software. Create complete business solutions.

Strategic Alliances – Partner with crypto wallets or exchanges. Cross-promote to each other’s users. Expand market reach rapidly.

Building Valuable Partnerships

Focus on alignment first. Partners should share your business values. Misaligned partnerships create problems later.

Negotiate clear terms upfront. Define revenue sharing, responsibilities, and exit conditions. Put everything in writing.

Start small and prove value. Pilot programs reduce risk. Scale successful partnerships aggressively.

Communicate regularly with partners. Monthly check-ins maintain alignment. Address issues before they escalate.

Finding the Right Partners

Attend crypto and fintech conferences. Network with potential partners face-to-face. Relationships matter in this industry.

Join industry associations and forums. Participate in discussions meaningfully. Position yourself as a valuable partner.

Research potential partners thoroughly. Check reputation and track record. Bad partners damage your brand.

Crypto investment expertise helps evaluate partnership opportunities strategically.

Evaluate Lifewiki on Crypto Payment Integration

Third-party evaluations provide unbiased perspectives. They help businesses make informed decisions.

What Independent Reviews Cover

Technical Implementation – How easy is integration? Does documentation help or confuse? What technical skills are required?

Cost Analysis – Are fees competitive? Any hidden charges? How does pricing scale with volume?

Security Assessment – What security measures exist? Has the platform faced breaches? How do they handle disputes?

User Experience – Is checkout smooth? Do customers complete transactions? What’s the average completion rate?

Key Evaluation Metrics

| Metric | Good | Average | Poor |

|---|---|---|---|

| Integration Time | < 2 hours | 2-8 hours | > 8 hours |

| Transaction Success Rate | > 95% | 90-95% | < 90% |

| Average Fees | < 1% | 1-2% | > 2% |

| Support Response Time | < 2 hours | 2-24 hours | > 24 hours |

| User Satisfaction | > 4.5/5 | 3.5-4.5/5 | < 3.5/5 |

Use these benchmarks when comparing options. Numbers reveal platform quality quickly.

Making Your Decision

Don’t rely on a single review source. Check multiple evaluations from different perspectives. Look for consistent feedback patterns.

Test platforms yourself when possible. Most offer sandbox environments. Hands-on experience beats reading alone.

Consider your specific use case. A perfect solution for e-commerce might fail for subscriptions. Match features to your needs.

Prioritize support quality. You’ll need help eventually. Responsive support saves money long-term.

Charge Crypto Payment Integration Best Practices

Optimizing the charging process increases conversions. Small details make big differences.

Pricing Display Strategies

Show prices in customer’s local currency first. Display crypto amount as secondary information. Don’t assume crypto literacy.

Lock exchange rates during checkout. Give customers 10-15 minutes to complete payment. Eliminates confusion from price changes.

Round to friendly numbers when possible. $99.95 feels better than 0.00247 BTC. Psychology matters in checkout flows.

Highlight savings from crypto payments. “Save 2% on fees” encourages adoption. Make benefits obvious immediately.

Checkout Flow Optimization

Reduce steps to absolute minimum. Every extra click loses customers. Three steps maximum is ideal.

Provide clear payment instructions. Assume customers are new to crypto. Include screenshots or video guides.

Show transaction status in real-time. “Broadcasting transaction” then “Confirming” keeps users informed. Uncertainty kills conversions.

Send confirmation emails immediately. Include transaction details and delivery timeline. Professional communication builds trust.

Handling Payment Issues

Create automated retry systems. Network congestion causes temporary failures. Auto-retry prevents lost sales.

Provide manual payment options as backup. Sometimes automation fails. Human intervention saves transactions.

Train support staff on crypto basics. They’ll answer questions confidently. Customer satisfaction improves dramatically.

Monitor failed transactions closely. Identify patterns and fix root causes. Continuous improvement matters.

Crypto Payment Integration Network Effects

Network effects accelerate adoption. Understanding them helps plan growth.

How Network Effects Work

More merchants accepting crypto = more customers holding crypto. More customers = more merchants interested. The cycle reinforces itself.

Early adopters gain maximum advantage. They capture new market share first. Later entrants compete harder for attention.

Building Your Network Position

Partner with complementary businesses. Cross-promote crypto payment options. Share customer bases strategically.

Participate in crypto communities actively. Reddit, Discord, and Twitter drive awareness. Become a recognized participant.

Create educational content consistently. Blog posts, videos, and guides attract searches. Position yourself as an expert resource.

Offer referral incentives to customers. “Get $10 for referring a friend” spreads adoption. Word-of-mouth remains powerful.

Measuring Network Growth

Track merchant adoption in your niche. Are competitors implementing crypto? Market maturity affects timing.

Monitor cryptocurrency holder growth rates. More holders = larger potential market. Timing implementation matters.

Analyze search volume trends. Rising searches indicate growing interest. Enter markets on upward trajectories.

Watch regulatory developments closely. Favorable regulations accelerate adoption. Plan accordingly for your region.

Frequently Asked Questions

What is the easiest crypto payment integration for beginners?

Shopify and WooCommerce offer the simplest implementations. Install a plugin, connect your wallet, and you’re ready. No coding needed. Both platforms handle technical complexity automatically. Start with these if you’re new to crypto payments.

How much does crypto payment integration cost?

Most services charge 0.5-1% per transaction. Setup is typically free. Some platforms add monthly fees of $10-50. Calculate total costs including conversion fees. High-volume businesses often negotiate better rates with providers directly.

Is seamless crypto payment integration secure for my business?

Yes, when implemented correctly. Use reputable payment processors with proven track records. Enable two-factor authentication and multi-signature wallets. Keep most funds in cold storage. Security depends on following best practices consistently.

Can I integrate crypto payments without technical knowledge?

Absolutely. Modern platforms require no coding skills. Shopify crypto payment integration takes 15 minutes. WooCommerce is equally simple. Follow step-by-step guides from your payment processor. Technical support helps with any issues.

What cryptocurrencies should I accept first?

Start with Bitcoin, Ethereum, and USDT stablecoin. These three cover 90% of crypto users. They’re widely held and well-established. Add more coins later based on customer requests. Focus on major currencies initially.

How do I handle crypto payment integration refunds?

Issue refunds in the same cryptocurrency received. Most payment processors automate this process. Alternatively, refund in fiat currency to avoid volatility. Establish clear refund policies upfront. Communicate them clearly during checkout.

Conclusion

Crypto payment integration opens new revenue opportunities. You’ve learned implementation steps for major platforms. You understand security requirements and best practices. You know how to choose the right service provider.

Start simple with WooCommerce or Shopify integration. Test with small transactions initially. Scale as you gain confidence and experience. The technology works reliably when implemented properly.

Your customers want more payment options. Crypto offers speed, low fees, and global reach. Competitors are already implementing these systems. Don’t fall behind in payment innovation.

Take action today. Choose your platform and payment processor. Complete integration this week. Your first crypto transaction will prove the concept. Growth follows naturally from there.