What Is Cryptocurrency: Your Complete Guide to Digital Money in 2026

What is cryptocurrency? It’s a question millions ask as digital money reshapes finance.

Many people hear about Bitcoin and blockchain but feel lost. The jargon sounds complicated. The technology seems mysterious.

Here’s the truth: Understanding crypto doesn’t require a tech degree. This guide breaks down everything in simple terms. You’ll learn how it works, why it matters, and how to start safely.

Let’s decode digital currency together.

Understanding What Is Cryptocurrency in Simple Terms

Cryptocurrency is digital money that lives online. No physical coins. No paper bills. Just code.

Think of it like email for money. Email revolutionized communication by removing middlemen. Crypto does the same for payments.

Traditional banks control your money. They verify transactions, charge fees, and set the rules.

Crypto removes these gatekeepers. Transactions happen directly between people. A technology called blockchain handles verification. No bank needed.

The Simple Explanation Everyone Can Understand

Here’s crypto in one sentence: Digital cash that works without banks.

You store it in a digital wallet on your phone or computer. You send it anywhere instantly. Fees stay incredibly low.

The “crypto” part means encryption. Special codes protect your money. Only you can access it with your private key.

Nobody owns or controls cryptocurrency networks. They run on thousands of computers worldwide. This makes them incredibly difficult to shut down or manipulate.

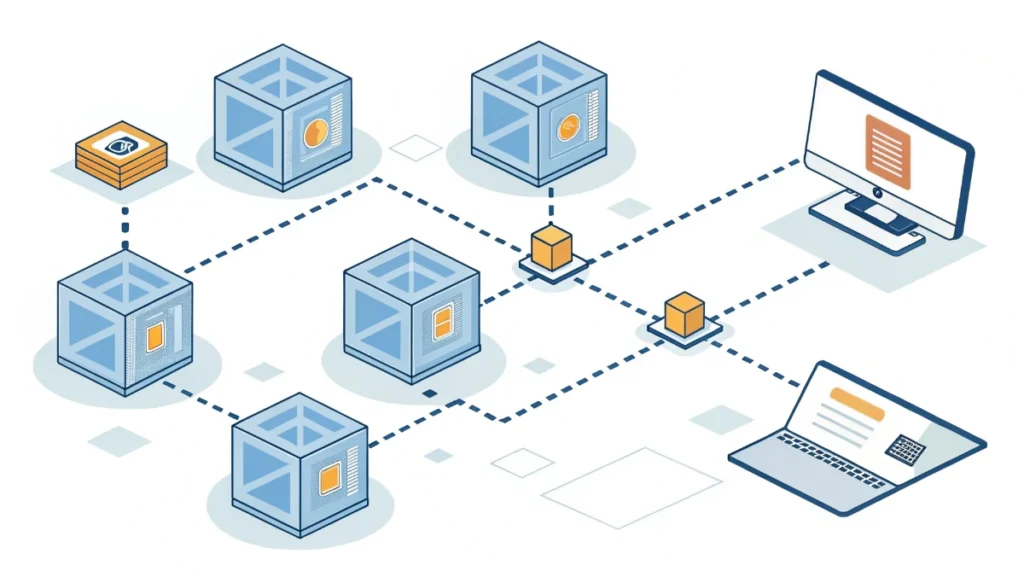

What Is Cryptocurrency Based On? The Blockchain Foundation

Blockchain technology powers every cryptocurrency. Understanding this matters.

Picture a notebook that records every transaction. Everyone gets a copy. Nobody can erase or change entries. That’s blockchain in action.

How Blockchain Creates Trust

Each transaction gets grouped into a “block.” Blocks link together forming a “chain.” Hence the name.

Thousands of computers verify each block. They all must agree before adding it. This prevents fraud automatically.

Once recorded, transactions become permanent. You can’t reverse them. You can’t fake them. Everyone can verify them.

This transparency builds trust without needing banks or governments.

Why Decentralization Matters

Traditional systems have a central authority. Banks control accounts. Governments print money. Central servers store data.

Crypto distributes power across networks. No single entity controls anything. This creates several advantages:

- No censorship: Nobody can freeze your account

- 24/7 access: Networks never close for holidays

- Global reach: Send money anywhere instantly

- Lower costs: No middlemen taking cuts

Decentralization also means responsibility. You control your keys. Lose them, and you lose access forever.

What Is Cryptocurrency and How Does It Work?

Let’s walk through a typical transaction. Understanding the mechanics helps everything click.

You want to send crypto to a friend. You open your wallet app. Enter their address and the amount. Hit send.

The Transaction Journey

Your transaction broadcasts to the network. Thousands of computers receive it. They verify you have enough funds. They check your digital signature.

These computers are called validators or miners. They compete to process transactions. Winners earn cryptocurrency rewards.

Once verified, your transaction joins a block. The block gets added to the blockchain. Your friend receives the funds.

This entire process takes minutes, sometimes seconds. Compare that to bank wires taking days.

What Makes Cryptocurrency Secure

Security comes from mathematics, not trust. Every wallet has two keys:

Public key: Like your email address. Share it freely to receive payments.

Private key: Like your password. Never share it. Anyone with it controls your crypto.

Advanced encryption protects these keys. Breaking the encryption would require more computing power than exists on Earth.

The decentralized nature adds another security layer. Hacking one computer does nothing. You’d need to compromise thousands simultaneously.

What Is Cryptocurrency Mining and How It Creates New Coins

Mining serves two purposes. It verifies transactions and creates new cryptocurrency.

Think of miners as accountants and lottery players combined. They maintain the blockchain while competing for rewards.

The Mining Process Explained

Miners use powerful computers to solve complex math puzzles. The first to solve gets the reward. This happens every few minutes.

These puzzles require enormous computational power. Specialized equipment called ASICs dominates Bitcoin mining. Regular computers can’t compete anymore.

The difficulty adjusts automatically. More miners mean harder puzzles. This keeps new coins flowing at a steady rate.

Bitcoin mining rewards halve every four years. Currently, miners earn less than when Bitcoin launched. This creates scarcity over time.

Is Mining Profitable Today?

Mining profitability depends on several factors:

- Electricity costs: Mining consumes massive energy

- Equipment prices: Professional rigs cost thousands

- Cryptocurrency value: Prices fluctuate constantly

- Mining difficulty: Competition keeps increasing

Most profitable mining happens at industrial scale now. Home mining rarely makes financial sense for Bitcoin.

However, some newer cryptocurrencies remain accessible to smaller miners. Research thoroughly before investing in equipment.

Consider starting a crypto business focused on services rather than mining if you’re exploring opportunities.

What Is Cryptocurrency Used For? Real-World Applications

Crypto serves multiple purposes beyond speculation. Practical uses continue expanding.

Everyday Transactions

Thousands of businesses now accept cryptocurrency payments. Coffee shops, online retailers, and service providers join daily.

Crypto payment integration offers merchants lower fees than credit cards. Transactions settle faster too. Chargebacks become impossible.

International transfers showcase crypto’s power. Send money across borders in minutes. Traditional wires take days and cost significantly more.

Investment and Wealth Building

Many view cryptocurrency as digital gold. Bitcoin’s limited supply creates scarcity. Only 21 million will ever exist.

Since launching in 2009, Bitcoin has grown tremendously. Early adopters saw life-changing returns. Past performance never guarantees future results though.

Diversification attracts traditional investors. Crypto behaves differently than stocks or bonds. This potentially reduces overall portfolio risk.

Check PedroVazPaulo crypto investment strategies for professional guidance on building positions.

Specialized Industry Uses

Different cryptocurrencies target specific industries. Some focus on healthcare data. Others handle supply chain tracking. Gaming platforms create entire economies.

Industry-specific cryptocurrencies solve particular problems. They’re not just money. They’re tools for innovation.

Smart contracts automate agreements. When conditions are met, payments execute automatically. No lawyers needed. No disputes about terms.

What Is Cryptocurrency Investment? Strategies and Approaches

Investing in crypto differs from traditional markets. The volatility creates both opportunity and risk.

Investment Strategy Comparison

| Strategy | Time Frame | Risk Level | Best For |

|---|---|---|---|

| Buy and Hold | Years | Medium | Patient investors believing in long-term growth |

| Active Trading | Days to weeks | High | Experienced traders with time and skill |

| Dollar-Cost Averaging | Months | Medium-Low | Beginners wanting to reduce timing risk |

| Staking | Ongoing | Low-Medium | Holders wanting passive income |

Long-Term vs Short-Term Approaches

Long-term holders ignore daily price swings. They believe crypto will appreciate over years. Bitcoin and Ethereum have rewarded this patience historically.

Short-term traders capitalize on volatility. They buy dips and sell peaks. This requires constant attention and technical analysis skills.

Most beginners should start with long-term strategies. Emotional trading often leads to losses. Patience typically wins with crypto.

Choosing the right cryptocurrency depends on your goals, risk tolerance, and investment timeline.

Risk Management Essentials

Never invest more than you can afford to lose. Crypto remains highly volatile. Prices can drop 50% or more quickly.

Diversify across multiple cryptocurrencies. Don’t put everything into one coin. Spread risk intelligently.

Use secure storage methods. Hardware wallets offer maximum security. Exchange accounts face hacking risks.

Understand tax implications. Most countries treat crypto as property. You owe taxes on profitable trades.

What Is Cryptocurrency Trading? Getting Started Safely

Trading involves buying and selling crypto for profit. It’s more active than investing.

Understanding Exchange Platforms

Exchanges are marketplaces for cryptocurrency. Think stock market for digital coins.

Centralized exchanges act as intermediaries. They hold your funds. They match buyers and sellers. Examples include Coinbase and Kraken.

Decentralized exchanges let users trade directly. No company controls them. More privacy but steeper learning curves.

Choose exchanges carefully. Check security history. Verify regulatory compliance. Read user reviews thoroughly.

Basic Trading Concepts

Market orders execute immediately at current prices. Simple but may cost more during volatility.

Limit orders trigger only at specified prices. More control but transactions may never complete.

Stop losses automatically sell if prices drop too far. They protect against major losses during crashes.

Trading fees vary significantly. Compare rates across platforms. Small differences compound over time.

Common Beginner Mistakes

Don’t chase pumps. Buying after major price increases often leads to losses. You’re catching a falling knife.

Avoid emotional decisions. Fear and greed cloud judgment. Stick to your predetermined strategy.

Never share private keys. Legitimate exchanges never ask for them. This is always a scam attempt.

Research before buying. Understand what you’re purchasing. Many projects promise everything but deliver nothing.

What Is Cryptocurrency Staking? Earning Passive Income

Staking lets you earn rewards by holding cryptocurrency. It’s like earning interest at a bank.

How Staking Works

Some cryptocurrencies use proof-of-stake for security. Holders “stake” their coins to validate transactions. The network rewards them periodically.

You lock up your crypto for a set period. During this time, you can’t sell or transfer it. Your coins help secure the network.

Rewards vary by cryptocurrency. Some offer 5% annually. Others promise much more. Higher returns usually mean higher risks.

Staking vs Mining Comparison

| Aspect | Staking | Mining |

|---|---|---|

| Energy Use | Minimal | Extremely high |

| Equipment Cost | None needed | Thousands of dollars |

| Technical Knowledge | Basic | Advanced |

| Profitability | Predictable | Variable |

| Accessibility | Anyone with coins | Requires investment |

Popular Staking Options

Ethereum switched to proof-of-stake in 2022. You can stake ETH directly or through pools. Minimum requirements apply for solo staking.

Cardano offers straightforward staking. Rewards arrive every five days. No lockup period required.

Solana provides competitive yields. The process is user-friendly. Many wallets include built-in staking.

Consider cryptocurrency Pi Network as an alternative approach to earning crypto through mobile mining.

Always research the project thoroughly. High promised returns often hide serious risks. Sustainability matters more than flashy numbers.

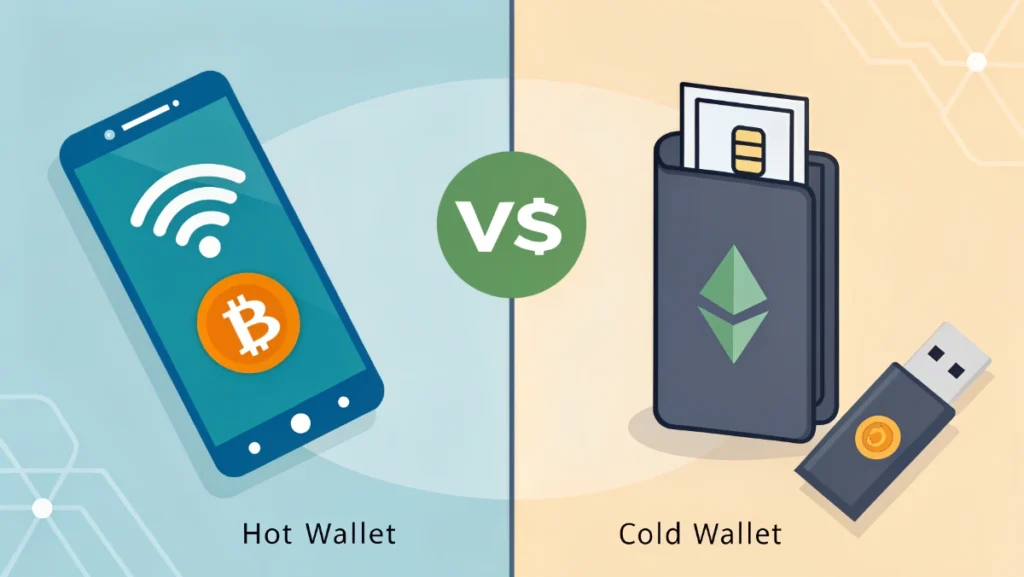

What Is Cryptocurrency Wallet? Securing Your Digital Assets

Wallets store your cryptocurrency safely. They manage your private keys. Choosing the right one matters enormously.

Wallet Types Explained

Hot wallets connect to the internet. They’re convenient for frequent trading. Mobile apps and browser extensions are common examples.

Security risks increase with convenience. Hackers target internet-connected wallets. Only keep small amounts in hot wallets.

Cold wallets stay offline. Hardware devices look like USB drives. They offer maximum security for long-term storage.

Paper wallets are another cold option. Print your keys and store them safely. Free but risky if paper gets damaged.

Setting Up Your First Wallet

Choose a reputable wallet provider. Check reviews and security features. Avoid unknown or new options.

Write down your recovery phrase. This 12-24 word backup restores access if you lose your device. Never store it digitally.

Test with small amounts first. Send a tiny transaction. Verify everything works correctly. Then transfer larger amounts.

Enable all security features. Two-factor authentication adds crucial protection. Biometric locks help too.

Storage Best Practices

Never share your private key with anyone. Legitimate services never ask for it. This is always a scam.

Use different wallets for different purposes. Keep trading funds separate from long-term holdings. This limits potential losses.

Back up everything multiple times. Store copies in different locations. Fire, water, or theft can destroy single backups.

Update wallet software regularly. Security patches fix newly discovered vulnerabilities. Outdated software invites trouble.

What Is Cryptocurrency Exchange? Your Gateway to Digital Money

Exchanges are platforms where you buy, sell, and trade cryptocurrency. They connect buyers with sellers.

Choosing the Right Exchange

Security should be your top priority. Research the exchange’s track record. Has it been hacked before? How did they respond?

Fees vary dramatically between platforms. Trading fees, withdrawal fees, and deposit fees all affect profitability. Calculate total costs carefully.

Available cryptocurrencies differ across exchanges. Some offer hundreds of options. Others stick to major coins only.

User interface matters for beginners. Complicated platforms overwhelm newcomers. Start with beginner-friendly options.

Account Setup Process

Registration requires personal information. Exchanges must comply with regulations. Expect to verify your identity.

Provide government ID, proof of address, and sometimes selfie photos. This prevents money laundering and fraud.

Connect a bank account or debit card. Funding methods affect fees and processing times. Bank transfers cost less but take longer.

Start with small purchases. Learn the interface with minimal risk. Increase amounts as comfort grows.

Security Tips for Exchange Users

Enable two-factor authentication immediately. This prevents unauthorized access even if passwords leak.

Use unique, strong passwords. Password managers help create and store complex combinations. Never reuse passwords across sites.

Withdraw to personal wallets regularly. Don’t treat exchanges like banks. They’re trading platforms, not storage solutions.

Beware of phishing attempts. Scammers create fake exchange websites. Always verify URLs carefully before logging in.

Frequently Asked Questions

Key Takeaways: Your Cryptocurrency Journey Starts Here

Understanding what is cryptocurrency opens doors to financial innovation. Digital money operates without traditional gatekeepers. Blockchain technology provides security and transparency.

Start small and learn continuously. The crypto landscape changes rapidly. New opportunities emerge constantly.

Prioritize security over convenience. Protect your private keys religiously. Use reputable platforms exclusively.

Research thoroughly before investing. Not all cryptocurrencies offer real value. Many promise everything but deliver nothing.

The future of finance includes digital currency. Early understanding provides significant advantages. You now have the foundation to explore confidently.

Take your first step today. Download a reputable wallet. Buy a small amount of cryptocurrency. Experience this technology firsthand.

The digital money revolution continues accelerating. Will you watch from the sidelines or participate actively? Your financial future may depend on this decision.